American Medical Association Releases Guidance on Medical Student Participation in COVID-19 Response

April 5, 11:45 a.m. Medical students across the country, at institutions like Harvard University, New York University and the University of Kansas, are being permitted to graduate early to aid in the fight against COVID-19. Other students may be asked to help in patient care as part of their studies. The American Medical Association has now released guidance for medical schools and health systems on the involvement of medical students and early graduates.

“There are many opportunities for students to contribute to the clinical care of patients without engaging in direct physical contact with patients,” an introduction to the guidance reads. “However, in some institutions the workforce demands may be great enough that it is appropriate to consider including medical students in direct patient care.”

Among other recommendations, the AMA advises institutions to allow students to freely choose whether they would like to be involved in direct patient care, without incentives or coercion. Medical students should be given proper personal protective equipment and training on how to use it. Medical students should not be financially responsible for their own diagnosis and treatment of COVID-19 should they become sick from school-approved activities, the association said.

For institutions with early graduation options for medical students to aid in the pandemic, the association stresses that the option should be enacted on a voluntary basis and be founded on achievement of core competencies. Institutions should not compel students to begin their matched residencies earlier than originally intended and should grant graduates full status as employees with appropriate salaries and benefits, the organization advised.

— Lilah Burke

Governors Call for Quick Distribution of Stimulus

April 4, 12:25 p.m. The National Governors Association wrote to Betsy DeVos, the U.S. secretary of education, to ask for the Education Department to within two weeks distribute the $30 billion of education stabilization funds in the $2.2 trillion federal stimulus, of which $14 billion is allocated to higher education.

The Education Department should grant “maximum flexibility” to states for how to use the money, wrote Asa Hutchinson, the Republican governor of Arkansas and chair of NGA’s Education and Workforce Committee, and Jay Inslee, the Democratic governor of Washington and vice chair of the committee.

“States need time to establish both structures to evaluate student needs and processes to rapidly deploy these funds,” they said. “That work cannot begin until the department provides guidance about how and when it will send funding to the states. We urge the department to act quickly to distribute these funds.”

Specifically, the letter called for the department to allow flexibility to reimburse costs already incurred during the COVID-19 crisis by states, local governments and higher education entities.

In addition, the Center on Budget and Policy Priorities released estimates of the amounts of education stimulus each state will receive. The funding will vary widely, the group said, in part due to the share of Title I and Pell Grant students that attend institutions in each state.

For the $14 billion for higher education, the group said:

“Some 90 percent of this amount will be distributed directly to public and private colleges and universities based primarily on their share of Pell Grant recipients. Another 7.5 percent will go to Historically Black Colleges and Universities and other institutions primarily serving students of color. The Secretary of Education will distribute the remaining 2.5 percent to those institutions the secretary determines have been particularly harmed by the virus and economic downturn.”

— Paul Fain

Alabama System to Open $250M Lines of Credit

April 3, 5:21 p.m. The University of Alabama system is moving to secure hundreds of millions of dollars in credit lines as a financial backstop against issues caused by the coronavirus outbreak.

The executive committee of the system’s Board of Trustees approved securing $250 million in credit from two banks, Al.com reported.

“The resolutions passed today by the Board of Trustees Executive Committee give our System the capacity to provide an additional $250 million in liquidity if it were to be needed at any future point,” a system spokesperson told Al.com. “We consider this to be a form of insurance to assist our campuses and the UAB Health System as we respond to the COVID-19 crisis.”

— Rick Seltzer

College Board Offers At-Home AP Exam Details

April 3, 4:55 p.m. The College Board will offer at-home test taking for its 2020 Advanced Placement exams, beginning May 11.

Students will be able to take the open-note exams on any device. They will be able to type or write and upload answers to one or two free-response questions for most exams, the College Board said in an email to AP instructors Friday. Students worldwide will take each subject’s exam at the same time, and most will have 45 minutes to complete them, the email said.

Scoring will continue to be on a scale of 1 to 5, and students cannot earn points for “content that can be found in textbooks or online,” the email said. The College Board is “confident that the vast majority of higher ed institutions will award college credit as they have in the past” and said the at-home test taking has support from hundreds of colleges.

“We want to give every student the chance to earn the college credit they’ve worked toward throughout the year,” Trevor Packer, senior vice president of AP and instruction for the College Board, said in a statement. “That’s why we quickly set up a process that’s simple, secure, and accessible.”

— Greta Anderson

Immigration Lawyers Sue to Keep Foreign Nationals in Lawful Status

April 3, 4:46 p.m. The American Immigration Lawyers Association filed suit against U.S. Citizenship and Immigration Services today seeking the immediate suspension of immigration benefit deadlines and the maintenance of status for individuals on nonimmigrant visas, a group that includes students and exchange scholars and foreign health-care workers with temporary visas.

“This Court should declare that the COVID-19 pandemic constitutes [extraordinary circumstances] beyond the control of U.S. employers and foreign [nationals] seeking immigration benefits, including their legal representatives, and order USCIS to toll deadlines and the expiration dates for any individual’s lawful status, including the expiration dates for employment authorization where applicable,” the complaint states.

“In doing so, USCIS should ensure that all foreign nationals remain in lawful status, including but not limited to conditional lawful permanent residents, students, nonimmigrant workers, recipients of Deferred Action for Childhood Arrivals and those [with] Temporary Protected Status.”

A USCIS spokesperson declined to comment, saying it is the agency’s policy not to comment on pending litigation.

–Elizabeth Redden

Survey on Changes to Grading, Transcripts

April 3, 4:05 p.m. More than a quarter of colleges and universities (27 percent) are not making any changes to grading or transcript practices in response to the COVID-19 crisis, according to the results of a new survey from the American Association for Collegiate Registrars and Admissions Officers (AACRAO). The group surveyed its members and received responses from officials at more than 600 colleges, with 94 percent representing U.S. institutions.

Among respondents, 81 percent said they have moved to entirely online or remote classes for the remainder of the current term. And 23 percent have moved to online or remote classes for the summer, with an additional 38 percent considering such a move. Other highlights from the findings include:

- 79 percent anticipate that degrees will be posted to students’ records in the normal time frame.

- 47 percent have canceled graduation ceremonies with no alternative — 14 percent rescheduled for another date and 12 percent moved to a virtual option.

- 44 percent are adhering to current policy on academic standing for the term — 6 percent are suspending academic standing calculations for this term.

- Most institutions are either giving or considering giving students the choice to change one or more of their courses to pass/fail or another institutional equivalent.

AACRAO is planning rapid-response surveys on admissions, transfer and international students.

“The responses will help us develop guidance on a range of topics to support institutions as they review and adjust practices in light of the impact of this unprecedented situation,” Michael Reilly, the group’s executive director, said in a statement.

— Paul Fain

Northern Arizona Now Offering Room and Board Rebates

April 3, 3:45 p.m. Northern Arizona University is offering students a 25 percent credit for their spring housing and dining charges if they move out by April 16, the university’s president announced today.

Arizona’s universities have canceled in-person classes and moved to online learning. Many students balked at a lack of refunds, signing petitions and, in at least one case, filing a class-action lawsuit demanding reimbursements against the state’s Board of Regents.

Northern Arizona is the last public institution in the state to take the step, according to the Arizona Daily Sun. Over a week ago, the University of Arizona offered 10 percent of housing costs, and Arizona State University said this week that it would offer $1,500 in nonrefundable credits for students.

— Rick Seltzer

‘Massive’ Increases in LMS and Synchronous Video Usage

April 3, 1:10 p.m. Learning management system and synchronous video tool usage saw their two biggest coronavirus-related spikes on March 23 and March 30, according to the blog Phil on Ed Tech. Canvas LMS usage increased more than 60 percent in terms of maximum concurrent users in the past two weeks, and video uploads surged. D2L Brightspace’s Virtual Classroom saw 25 times more activity. Blackboard’s Learn LMS log-ins increased fourfold, and its Collaborate virtual classroom activity increased by a factor of 36. Moodle and MoodleCloud as well as Schoolology were far busier than normal.

Significantly, synchronous video and virtual classroom usage have increased even more than LMS usage. Consultant Phil Hill’s analysis is that this reflects a “preference of teachers to first try to replicate their face-to-face class in virtual environments.” That preference is the defining feature of Phase 1 of the transition to remote teaching and learning, Hill said, citing a huge jump in Zoom videoconferencing overall (Zoom doesn’t share education-specific numbers).

Hill’s post includes a fascinating graphic of how the remote learning transition will progress, through 2021. One specific prediction? “I would expect to see a reduction in synchronous video usage” as professors realize its limitations, including for disadvantaged students, “and a further increase in core LMS usage,” he said. At the same time, Hill said LMS providers will experience growing pains as they accommodate more and more users on existing subscriptions without gaining any corresponding revenue.

— Colleen Flaherty

Survey: DACA Recipients Face Job Loss and Other Stresses

April 3, 11:32 a.m. The Dream.US, an organization that provides scholarships to immigrant students known as Dreamers, released a survey Friday on the impact of COVID-19 on its scholars, the majority of whom are enrolled in the Deferred Action for Childhood Arrivals program, which provides work authorization and temporary protection against deportation to undocumented young immigrants who were brought to the U.S. as children. More than 1,600 Dreamers completed the survey, representing a 44.6 percent response rate.

Of the 76 percent of respondents who work while in school, 80 percent reported loss of income due to reduced work hours or temporary or permanent job losses. Half of respondents said they’d temporarily lost their jobs, and 7 percent said they’d permanently lost them.

Fifty-eight percent of Dreamers said they needed mental health support. Dreamers said their top needs are help with rent or utilities (65 percent cited this) and help with food or meals (cited by 48 percent). About a fifth of scholars — 21.8 percent — said they need help with free or low-cost wireless internet access, and 13.6 percent said they needed a free, borrowed or low-cost computer.

Candy Marshall, the president of TheDream.US, said in a news release that the survey “not only reminds us that Dreamers are facing heightened health worries and economic anxieties due to the impact of Covid-19, but are doing so while their own futures remain uncertain due to the precarious state of DACA,” the future of which is under consideration by the Supreme Court.

— Elizabeth Redden

Survey: Library Employees at Community Colleges Less Likely to Work Remotely

April 3, 10:25 a.m. Primary Research Group Inc. has published data from a survey of 70 academic library directors and deans at U.S. institutions, including community colleges and four-year institutions. The survey, which was conducted during the last week of March, asked directors to describe how their libraries were adjusting to remote working, assisting in distance learning efforts, disinfecting library materials, teaching information literacy, altering materials spending and distribution to the new online audience, among other questions about challenges due to the coronavirus pandemic.

Among respondents, roughly 96 percent said their institutions had moved all or most courses online until further notice. The rest said courses were canceled.

No libraries reported that an employee had been diagnosed with COVID-19, according to the survey.

Community colleges and smaller institutions were more likely to be struggling with remote-work arrangements, the survey found. That finding squares with reporting by The Washington Post about community college libraries remaining open for students to use library computers and other technology they can’t access elsewhere.

For example, only 35 percent of employees at community colleges were working remotely, compared to 75 percent of library employees at research universities. And the larger the college in terms of student enrollment, the greater the percentage of library employees were working remotely, the survey found.

At colleges with fewer than 1,500 students (full-time enrollment equivalent), only 44 percent of library employees were working from home. But 80 percent of library employees were working from home at colleges with enrollments of than 10,000 students.

The survey found that a plurality of respondents (about 50 percent) did not plan any major changes in their materials expenditures policies over the next six months. Primary Research Group said the survey was the second in a series, with a follow-up planned for release in May.

— Paul Fain

Ivy League Won’t Extend Eligibility

April 3, 10:10 a.m. The Ivy League announced yesterday that it will not give an extra year of eligibility to athletes who play spring sports and had their seasons cut short by the coronavirus pandemic.

That decision does not align with one made by the NCAA earlier this week to provide an extra year of eligibility. But it is in line with existing Ivy League policies, as the league has not allowed athletes to take part in sports as graduate students, the Associated Press reported.

“After a number of discussions surrounding the current circumstances, the Ivy League has decided the league’s existing eligibility policies will remain in place, including its longstanding practice that athletic opportunities are for undergraduates,” the league said in a statement.

— Rick Seltzer

Colleges Call for Quick Distribution of Stimulus Money

April 2, 4:00 p.m. Colleges and universities pressed U.S. Education Secretary Betsy DeVos to get the $14 billion earmarked for higher education in last week’s $2 trillion CARES Act stimulus package to institutions quickly.

“This crisis is causing massive disruption to students, institutional operations and institutional finances. On some campuses, it is creating an existential threat, potentially resulting in closures,” Ted Mitchell, president of the American Council on Education, said in the letter that was signed by 40 groups, including those representing four-year institutions and community colleges.

“I fear this funding will be for naught for many institutions unless the department can act very quickly to make these funds available,” Mitchell wrote.

Colleges and universities had asked for $50 billion in the bill to help pay for the financial toll of the pandemic on institutions, including potentially refunding room and board to students.

“We must stress that the assistance included for students and institutions in the CARES Act is far below what is essential to respond to the financial disasters confronting both,” Mitchell said. “It’s critical for the department to provide campuses with as much flexibility as possible for distributing these funds on campus, both for emergency grants to students and to help cover institutional refunds, expenses and other lost revenues.”

Mitchell also asked the department to clarify how the money can be used. “For example, it will be very helpful to know if the funding for emergency grants to students can be used to reimburse institutions for students’ expenses, such as housing, food, transportation, equipment and the like, that already have been or may soon be refunded or incurred on behalf of students,” the letter said.

Angela Morabito, a department spokeswoman, said disbursing the funds is a priority. “We understand the necessity to move quickly to get CARES Act relief funds to students and educators. An internal group of experts is working to create the most efficient process for this, and we look forward to sharing more details with the field in the coming days.”

— Kery Murakami

Different Take on Stimulus and OPMs

April 2, 3:35 p.m. Colleges and universities that contract with online program management (OPM) companies to help them transition to online instruction amid the pandemic may be unable to have their costs reimbursed under the $2.2 trillion federal stimulus, according to a recent blog post from the education practice of Cooley, a law firm. But officials from the OPM industry say the provision does not specifically target them and is likely to have an impact on existing college partnerships and online programs.

The section of the law that restricts payments to contractors for “pre-enrollment recruitment activities” is part of its broader goal of preventing colleges as well as contractors from using stimulus money to recruit new students, the officials said. And the stimulus restrictions on recruitment obviously do not apply to students who currently are enrolled and plan to return in the fall. Likewise, the provision does not appear to apply to existing partnerships between OPMs and colleges, and the officials said OPMs can still use their marketing dollars to recruit students under those arrangements.

— Paul Fain

Concern Over Safety, Transparency at City Colleges

April 2, 3:15 p.m. Union leaders for the City Colleges of Chicago are calling on the administration to do more to protect employees from the novel coronavirus.

The community college system has provided little guidance on their safety measures, according Tony Johnston, president of the Cook County College Teachers Union, and Dolores Withers, president of the Federation of College Clerical and Technical Employees, who held a news conference today.

Carmelita Cristobal, a clerical employee at Wilbur Wright College, died of complications from COVID-19, according to Johnston. It’s possible Cristobal was in contact with other employees while contagious, according to both Johnston and Withers.

Cristobal’s coworkers were told she was hospitalized with bronchitis, according to Audrey Butler, executive vice president of the federation.

Withers also said safety equipment is lacking for employees who are still reporting to campus. Supplies vary from campus to campus, she said. Leadership also is not providing the unions with a list of which employees are considered essential and required to report to campus, she said.

In a statement to Inside Higher Ed, City Colleges acknowledged that one of its employees who had COVID-19 has died.

“We are mourning the loss of our beloved community member. Due to privacy, no other details will be shared,” the statement reads. “Please rest assured that from the outset of COVID-19, City Colleges has followed the direction and guidance of the Chicago Department of Public Health on all COVID-19 matters and has sought specific counsel, feedback and approval from CDPH on all COVID related actions and communications and will continue to do so throughout this pandemic.”

All janitors have been provided gloves for cleaning, and hand sanitizer is available throughout all colleges, according to the statement.

— Madeline St. Amour

Ohio Wesleyan University Cancels Planned Tuition Increase

April 2, 1:51 p.m. Ohio Wesleyan University announced this week that it will not go ahead with a planned 3 percent tuition hike for the 2020-21 academic year. The tuition sticker price will remain at $46,870 for in-state, out-of-state and international students.

“The COVID-19 pandemic is causing dramatic financial challenges for some of our students and families, and we want to support them in this uncertain time,” said Rock Jones, the university’s president, in a statement.

— Emma Whitford

Athletic Directors Share Financial and Student Concerns

April 2, 1:07 p.m. A majority of athletic directors at universities with Division I football programs believe their departments will have to make financial sacrifices and consider reducing employee compensation as a result of the impact of the coronavirus on collegiate athletics, according to a survey released Thursday by the LEAD1 Association and Teamworks, an athlete engagement platform.

LEAD1, which represents 130 athletic directors in the National Collegiate Athletic Association’s Division I Football Bowl Subdivision, conducted the survey of more than 100 of its members. The vast majority, 86 percent, think their campuses will require them to make athletics budget cuts. The directors anticipate a bleaker financial outlook for 2020-21 than the current academic year, according to survey results.

“We have entered into a period of uncertainty and uncharted territory in college athletics,” Tom McMillen, president and CEO of LEAD1, said in a press release. “It is clear that the 100-plus athletics directors who responded to our survey believe their number one priority is to maintain the highest levels of physical health safety and academic progress for their student-athletes.”

A significant majority, 89 percent, of respondents reported they are most concerned about the academic progress of college athletes in the coming months, and 74 percent said a top concern is athletes’ mental health. Several directors suggested the NCAA suspend its Division I Academic Progress Rate, a team-based metric that accounts for retention of athletes and penalizes teams that do not meet certain benchmarks.

— Greta Anderson

April 2, 12:35 p.m. Amherst College in Massachusetts is asking for help raising funds to cover the switch to remote learning.

In a letter to the college community, Andrew J. Nussbaum, chair of the college’s trustees, asked for help covering the costs, which may exceed $10 million, according to MassLive Media.

“Financially, the College remains secure, though we will experience substantial increased costs to honor the commitments we have made. We estimate that the overall financial impact to the College of the move to remote learning may exceed the $10 million raised by the Amherst Fund last year,” Nussbaum wrote. “As you’d expect, the College’s endowment valuation has already declined, and may decline further, due to the economic environment.”

— Madeline St. Amour

How Coronavirus Spread at One University

April 2, 12:30 p.m. Parties. Spring break trips. St. Patrick’s Day celebrations.

Vanderbilt University students took part in all of these things, despite guidance to do otherwise from the university and health officials, according to a Reuters report.

Now, about 100 students may have COVID-19.

Reuters details how students held St. Patrick’s Day parties early, on the same day New York City canceled its parade. They also held parties when Vanderbilt announced classes would transition to online learning through March.

Several students who attended celebrations or traveled to Europe for spring break started feeling symptoms of the novel coronavirus. Now, more than 100 have formed a Facebook group to discuss their illnesses.

— Madeline St. Amour

New Survey: Job Loss and Need for More Education and Training

April 2, 10:53 a.m. The Strada Education Network has launched a weekly, nationally representative survey on the impact of COVID-19 on people’s careers as well as respondents’ perceived need for additional education and postsecondary training. The first batch of results comes as the U.S. Department of Labor reported that more than 6.6 million Americans filed unemployment claims last week, the highest level in U.S. history.

The new weekly poll, dubbed Public Viewpoint, is produced by Strada’s Center for Consumer Insights, a research group that “studies the experiences and perceptions of American adults in order to inform the development of a more consumer-centered learning ecosystem.”

Among the initial report of results from 1,006 U.S. adults on March 25-26: 46 percent of individuals surveyed reported they have lost their job or had their income reduced due to COVID-19 impacts. The survey also found that 55 percent of respondents expected their finances to be negatively impacted due to the pandemic, with 57 percent reporting they were worried about losing their job.

One-third of respondents think that if they lost their job, they would need additional education and training to get a comparable job. And two-thirds of those surveyed said more education is essential in times of economic uncertainty.

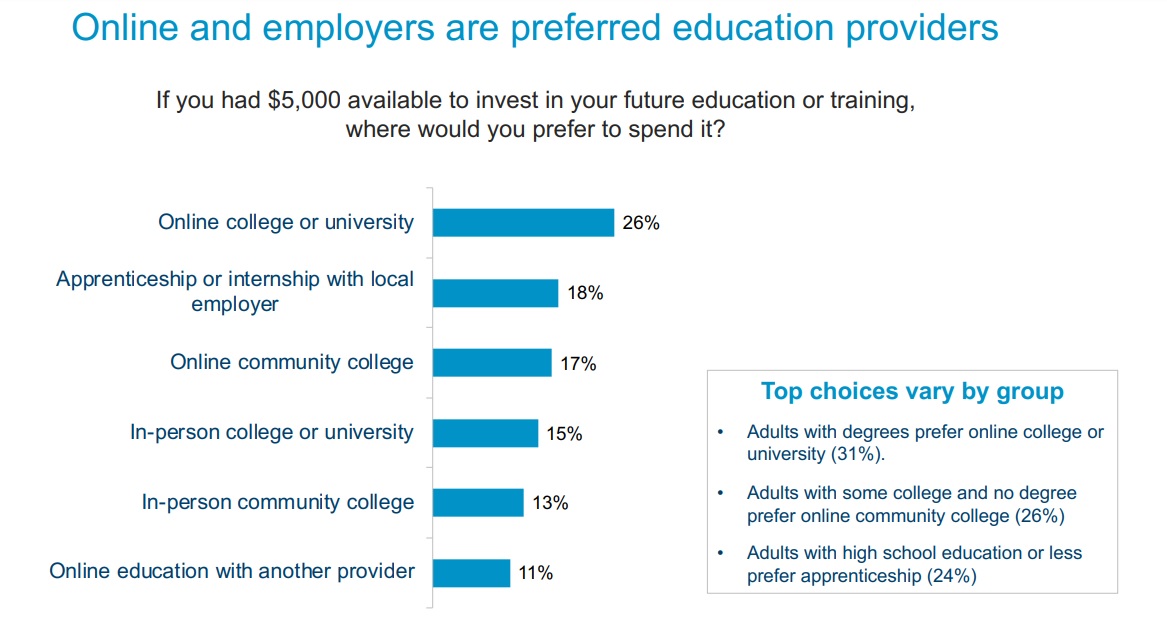

When asked where they would invest $5,000 in their future education or training, respondents were most likely to say an online college or university. Apprenticeships or internships with a local employer were the next most common choice, followed by online community college, in-person programs at colleges or universities, in-person programs at community colleges and online education with another provider (see below).

“By tracking consumer sentiment weekly during this unprecedented time, we hope to provide insights that can inform the response of policy makers and education providers, as well as identify the emerging role of education in economic recovery,” said Dave Clayton, senior vice president of consumer insights at Strada, which describes itself as a national social impact organization.

— Paul Fain

Call for More Education Funding in Next Stimulus

April 2, 10:25 a.m. The Center for American Progress on Thursday urged Congress to immediately begin working on another coronavirus relief package, saying the help for education in the $2.2 trillion bill passed last week was inadequate.

“The roughly $43 billion targeted for early childhood education, K-12, and higher education will only make a dent in addressing the long-term crisis for education funding,” the progressive group said in a report.

In a series of recommendations, the group said Congress should in the short term extend the six-month suspension of student loan payments in the last package to the 1.9 million borrowers with Perkins loans and 7.9 million with commercially held Federal Family Education Loans, who were excluded from the bill.

CAP also said interest should not be capitalized for those who get a break from making payments, so their monthly payment amounts do not go up when they have to start making them again.

In the longer term, the group urged the cancellation of student debt “that is particularly targeted toward borrowers with a high risk of defaulting and toward borrowers of color.”

More broadly, CAP urged more funding for higher education through a federal-state partnership with conditions on states to not cut their spending on colleges and universities, which were devastated by state funding reductions during the recession of the late 2000s.

“Congress has a great deal more work to do to ensure that all children and students, from cradle to career, are equitably supported,” the group said in the report.

— Kery Murakami

Budget Withholdings in Missouri

April 1, 5:35 p.m. Missouri is hitting the state’s university with a large budget withholding.

The withholdings for the University of Missouri will total about $36.5 million, according to a news release.

“We appreciate everything that our elected officials are doing during this unprecedented time,” Mun Choi, the system’s president, said in the release. “The state is working hard to prioritize its resources, and we must all work together to get past this crisis. The UM System and all four of our universities are also taking thoughtful but necessary actions and remain focused on achieving our mission for student success, research and engagement with the State of Missouri and beyond.”

Choi added that the university’s goals are to ensure long-term viability and uphold its mission, and leadership expects make difficult decisions to achieve those goals.

— Madeline St. Amour

Moody’s: Coronavirus Expenses Likely Far Exceed New Stimulus Money for Higher Ed

April 1, 4:35 p.m. The recently enacted federal package providing coronavirus aid and economic stimulus is mildly credit positive for the higher education sector, Moody’s Investors Service said Wednesday.

The March 27 package created a $31 billion Education Stabilization Fund. About $14 billion goes directly to higher education, and governors can use another $3 billion for higher education or K-12 at their discretion. The remainder goes to K-12.

But that’s a small amount compared to the hundreds of billions of dollars Moody’s expected colleges and universities to spend this year.

“For fiscal 2020, Moody’s estimates the higher education sector would have incurred about $640 billion in expenditures before the impact of the coronavirus,” said Susan Fitzgerald, associate managing director at the ratings agency, in a statement. “Of the $14 billion allocated to higher education, universities need to use at least half for emergency financial aid to students for housing, food, childcare and other costs. The remainder will offset the lost revenue and increased expenses due to coronavirus. Assuming half is allocated to financial aid, the remainder is equal to around 1 percent of total university expenditures.”

Lost revenue and additional expenditures related to the coronavirus outbreak are likely to exceed the amount of aid colleges and universities receive, according to Moody’s. Therefore, financial performance for the sector is expected to tighten.

— Rick Seltzer

Acadeum Launches Course Recovery Consortium

April 1, 4:20 p.m. Acadeum, a company that allows colleges and universities to share seats for online classes in a consortium model, today announced its Higher Education Course Recovery Consortium. The coalition of 19 universities is offering open spots in online courses at discounts, with the goal of ensuring continuity for students whose educational trajectory has been altered by the pandemic.

“As of today, more than one million seats are available through the end of 2020 in regionally accredited asynchronous online courses with flexible start times and offered in differing lengths, ranging from introductory, general education to highly specialized topics to meet specific major requirements,” Acadeum’s co-founder, Robert Manzer, wrote in the announcement. “We cannot allow this moment to set back student success.”

— Lilah Burke

AAUP Issues Standards on Faculty Rights During COVID-19

April 1, 2:30 p.m. The American Association of University Professors today released a new FAQ-style document on principles and standards for the COVID-19 crisis.

Answers draw on widely followed AAUP polices on academic freedom, tenure and shared governance, as well as AAUP’s advocacy regarding faculty terminations in New Orleans after Hurricane Katrina. The upshot is that a disaster is not a time to suspend faculty rights or the faculty role in institutional decision making. Among other topics, questions and answers address targeted harassment of professors teaching online, how student evaluations of teaching should be read and faculty rights at financially stressed institutions.

— Colleen Flaherty

Martin Luther College President Tests Positive for COVID-19

April 1, 2:07 p.m. Martin Luther College president Mark Zarling tested positive for COVID-19, the small private college announced Monday.

Zarling’s case is the first reported in Brown County, Minn.

He has been hospitalized in Mankato, according to the Marshall Independent, but is expected to be released to recover at home.

In a statement, the college said that anyone who had prolonged contact with Zarling was put on a 14-day quarantine beginning March 24, and that no one in the quarantine group has reported symptoms that would require COVID-19 testing as of Monday. Zarling was being treated at an emergency facility.

A college spokesperson told the Marshall Independent that Zarling had traveled to the Seattle area earlier in the year, and it is assumed that is where he was first exposed.

— Emma Whitford

Admissions Requirements Relaxed at University of California

April 1, 1:25 p.m. The University of California is relaxing admissions requirements for students who enroll in fall 2020 and the foreseeable future.

Many high schools have switched to remote instruction in light of the coronavirus pandemic, and some have switched to pass/fail grading models that are not accepted by the California system, according to a news release. Standardized testing and college entrance exams have also been canceled.

In response, the system’s regents are taking efforts to ease the burden on students seeking college admission. The letter grade requirement will be suspended for winter, spring and summer 2020 classes for all students. Standardized testing won’t be required for fall 2021 freshman admission. The cap on the number of transferable pass/no pass units will be suspended for transfer students.

“The COVID-19 outbreak is a disaster of historic proportions disrupting every aspect of our lives, including education for high school students, among others,” Janet Napolitano, president of the University of California, said in the release. “The university’s flexibility at this crucial time will ensure prospective students aiming for UC get a full and fair shot — no matter their current challenges.”

— Madeline St. Amour

Nonprofit Offers Relief Funds for Law Students

April 1, 12:55 p.m. AccessLex Institute has created a $5 million emergency relief fund for law students.

The institute is a nonprofit that helps aspiring lawyers achieve professional success. Its relief fund will provide direct resources to law students affected by the novel coronavirus, according to a news release.

The fund will make $25,000 available to the emergency funds of every nonprofit and state-affiliated American Bar Association-approved law school in the nation.

“Beyond the concerns around adapting to online learning, completion of hands-on legal clinics, and the potential for delays in the bar exam, this crisis has exacerbated financial pressures on law students — in many cases, to a level that can jeopardize the continuation of their studies,” the release said.

“It is imperative that we act on our mission to positively impact the lives of law students in a tangible way when they need the support most,” Christopher Chapman, president and CEO of AccessLex, said in the release. “The establishment of the Emergency Relief Fund is simply the right thing for AccessLex to do during this unprecedented time. It represents a targeted response in our effort to be there for those we serve every day — the next generation of lawyers.”

— Madeline St. Amour

Scholarships, Free Trials at Chegg Subsidiary

April 1, 12:30 p.m. Thinkful, a subsidiary of online education company Chegg, is providing scholarships to help those who lose their jobs in the coronavirus pandemic.

The career accelerator is providing $1.5 million in scholarships in total, according to a news release. Four hundred students will each receive a $4,000 scholarship for full-time Thinkful programs.

Some part-time programs, including those in design, data science and software engineering, will be free for one month. Students who go this route can continue their education with income-share agreements, which let them delay payments until they start a new career.

The company is also expanding the availability of its income-share agreements.

— Madeline St. Amour

Restrictions Eased at Air Force Academy After 2 Suicides

April 1, 12:10 p.m. The Air Force Academy is easing lockdown restrictions after two cadets died by suicide in less than a week.

The academy has been under strict lockdown measures to prevent the spread of the coronavirus. About 1,000 senior cadets remain on the Colorado campus, and some have complained of prison-like conditions, according to The Colorado Springs Gazette.

Seniors were kept in isolation, taking classes online and getting takeout food from the dining hall. Those who broke the rules or got within six feet of another person were punished with marching tours.

Now, the cadets will be allowed to go off-campus for drive-through food, gather in small groups compliant with state policies and wear civilian clothing on Fridays. Officials at the academy are also encouraging staff to bring in their dogs for morale boosts.

— Madeline St. Amour

Regulatory Flexibility on Career Education

April 1, 11:00 a.m. States, local education agencies and higher education institutions will have more time to submit career and technical education (CTE) plans during the coronavirus crisis, U.S. Education Secretary Betsy DeVos announced.

Federal Perkins V funds are available for CTE programs but require plans to be submitted on how the programs would develop the academic, technical and employability skills of secondary and postsecondary students.

Under the new order, the Education Department will give an extension for states that need additional time to submit their Perkins state plans and will allow states and local Perkins recipients to receive their first installment of Perkins funds on time — even if they need an extension — while allowing states to provide funding recipients additional time to complete their applications.

— Kery Murakami

Most Loan Servicers Suspending Payment Requirements

April 1, 10:50 a.m. Nearly all private student loan servicers are committing to let borrowers suspend making payments for up to three months, said Scott Buchanan, executive director of the Student Loan Servicing Alliance.

But Buchanan, whose group represents the servicers, said it’s unclear if all will also waive interest, or if interest will be added on to borrowers’ balances and monthly payments when the suspensions are lifted.

Private loans were not included in the relief most borrowers with federal student loans received in the stimulus package Congress passed last week, or in recent administrative steps U.S. Education Secretary Betsy DeVos has announced, including a 60-day deferral on monthly payments and a commitment to not garnish the wages, tax refunds or Social Security benefits of those who fall behind in making private loan payments.

“Every lender has their own policies and procedures so that’s why students need to call their servicer if they are in distress — if not they can continue to pay so their loans get paid off,” Buchanan said in an email.

“SLSA’s members are focused on ensuring that those who will struggle to make payments today have a real and practical option to minimize any further negative impacts by this unprecedented crisis,” he said. “We understand the severity of the situation — as our employees and families are being impacted as well — and are meeting it by helping to provide those impacted an ability to temporarily suspend their payments.”

— Kery Murakami

Education Department’s Proposed Distance Ed Rules

April 1, 9:40 a.m. A panel of negotiators selected by the U.S. Department of Education last year reached consensus on new proposed rules for distance education, a hot topic amid the pandemic and broad pivot to virtual learning by most colleges. The department today released its proposed final version of the rules.

The rules on distance education are both complex and contentious. They highlight long-standing tensions between consumer advocates who want stronger state-level protections for students and higher education groups that seek shared national standards, as Lindsay McKenzie reported last year.

The department said the proposed new rules would:

- Emphasize demonstrated learning over seat time.

- Remove confusion over whether a course is eligible for Title IV aid by defining “regular and substantive” interaction between students and instructors.

- Clarify and simplify the requirements for direct assessment programs, including how to determine equivalent credit hours.

- Add a definition of “juvenile justice facility” to ensure that incarcerated students remain Pell eligible.

- Allow students enrolled in Title IV, Higher Education Act (HEA)-eligible foreign institutions to complete up to 25 percent of their programs at an eligible U.S. institution. This provision is particularly important for students temporarily unable to attend courses abroad due to the COVID-19 pandemic.

- Encourage employer participation in developing educational programs.

- Create a new, student-centric system for disbursing Title IV, HEA assistance to students in subscription-based programs.

- Require prompt action by the department on applications to participate, or continue to participate, as an eligible institution in the HEA, Title IV program. In the past, these applications have been stalled for months or even years.

The rules will be published in the Federal Register for a 30-day public comment period. The department said it will publish a final version by Nov. 1.

“With our support, colleges and universities were among the first to transition to online and distance learning so learning could continue during the coronavirus pandemic,” Betsy DeVos, the U.S. education secretary, said in a statement. “Frankly, though, they are working within the confines of stale rules and regulations that are in desperate need of rethinking. We know there are fewer and fewer ‘traditional’ students in higher education, and this current crisis has made crystal clear the need for more innovation. It’s past time we rethink higher ed to meet the needs of all students. Fortunately, we started work last year to develop a new set of standards that are responsive to current realities, that embrace new technology, that open doors for much-needed innovation in higher education, and that expand access for students to the flexible, relevant education opportunities they need.”

— Paul Fain

Spring Breakers From UT Austin Test Positive

March 31, 5:35 p.m. University of Texas at Austin students have tested positive for COVID-19 after returning from a spring break trip to Mexico.

About 70 young adults took a chartered plane to Cabo San Lucas, according to reports from NBC News. Once they returned, 28 tested positive for the virus, all of whom are students at UT Austin. The entire group is now under public health investigation.

The university is closely monitoring others who were on the flight. Those with confirmed cases are self-isolating.

— Madeline St. Amour

March 31, 3:40 p.m. China’s high-stakes national college entrance exam, the gaokao, is being postponed by one month, until July, due to the coronavirus, Sixth Tone reported. The Chinese Ministry of Education said it was postponing the nine-hour standardized test to give students whose educations were shifted online extra time to prepare. “Given the different online study conditions across urban and rural areas, the impact on some students preparing for the exam in villages and poor areas has been much greater,” the ministry said in a statement.

— Elizabeth Redden

Senators Urge DeVos to Wait on Title IX Rule

March 31, 3:06 p.m. Three Democratic U.S. senators sent a letter to U.S. Education Secretary Betsy DeVos opposing any plans by the Education Department to issue a final rule on Title IX of the Education Amendments Act of 1972 while schools are responding to the coronavirus pandemic.

Senators Elizabeth Warren, Kirsten Gillibrand and Patty Murray, the ranking member of the Senate’s education committee, wrote that releasing the final rule during the crisis would be “wholly unacceptable.” The final rule, proposed in November 2018, as it stands would require K-12 schools and colleges to “fundamentally” change the way they respond to incidents of sexual harassment and assault, the senators wrote.

“K-12 schools and institutions of higher education face unprecedented uncertainty about the end of this school year and the start of the next school year,” the letter said. “We urge you not to release the final Title IX rule at this time and instead to focus on helping schools navigate the urgent issues arising from the COVID-19 pandemic that is top of the mind for all students and families.”

— Greta Anderson

University of Arkansas Helping Small Businesses

March 31, 1:35 p.m. The University of Arkansas is creating an assistance program for small businesses impacted by the coronavirus.

The university’s Small Business and Technology Development Center is partnering with the Northwest Arkansas Council to create the Small Business Emergency Assistance program, which will assist nonprofits and small businesses in the region, according to a news release.

It will offer free services such as assistance with loan applications, financial reviews, market research, business planning and more.

“Small businesses and nonprofits are the heartbeat of our community,” Nelson Peacock, president and CEO of the Northwest Arkansas Council, said in the release. “We need to ensure eligible organizations are aware of all the available state and federal resources and aid packages to help them weather this crisis.”

Services will be provided remotely to ensure social distancing practices.

The program is supported by a grant from the Walton Family Foundation.

— Madeline St. Amour

March 31, 1:30 p.m. It’s not much, but it’s something: the Modern Language Association is offering $500 grants, by lottery, to part-time faculty members affected by COVID-19. Grants may be used to help make up for income lost to canceled courses, subsidize hours spent moving classes online or pay for personal technology used to teach. Eligible applicants are current MLA members who earn 50 percent or more of their income from part-time instruction at a college or university. They may not be eligible for benefits from any employer or in the first five years of their graduate studies. Applications are due May 1.

— Colleen Flaherty

UW Madison Estimates $100 Million Loss

March 31, 1:10 p.m. The University of Wisconsin at Madison anticipates an $100 million loss because of the COVID-19 pandemic, the Wisconsin State Journal has reported. Chancellor Rebecca Blank has said that estimate assumes operations will return to normal by June. Scientific models have not given a clear answer so far on whether that timeline will bear out.

The $100 million amount does not take into account refunds for tuition or fees, which Blank has said the university will not offer. But it does include prorated reimbursement of room and board fees.

The estimated figure is about 3.2 percent of Madison’s annual budget, and equivalent to a 22 percent cut in state funding for one year. The University of Wisconsin system cannot give an estimate for systemwide losses, but it estimates $78 million for room and board refunds.

— Lilah Burke

NCAA Division I Extends Spring Eligibility and Scholarships

March 31, 11:30 a.m. Division I athletes on spring teams will be permitted to compete for an additional season, and teams can provide scholarships for more athletes than rules typically allow, the National Collegiate Athletic Association announced Monday.

The adjusted limits will permit spring team coaches to grant scholarships to both incoming recruits and senior athletes who choose to continue to compete in 2020-21, but it will be up to institutions to decide whether to provide the aid, and how much. It is not required that senior athletes who return for the 2020-21 season retain the same scholarship they were awarded during 2019-20, according to an NCAA news release.

Institutions may also apply to extend the eligibility of all their spring athletes, not just seniors, by one year. And roster limits for baseball teams will be increased, the NCAA said. Athletes usually are permitted to compete for four seasons in a five-year period, but spring players this year had their seasons cut short due to the coronavirus pandemic. Many winter athletes also had championship tournaments canceled, but the Division I Council on Monday decided it would not make exemptions for them because “all or much of their regular seasons were completed.”

— Greta Anderson

Zoom Tutorials from UC Riverside Profs

March 31, 10:38 a.m. Two psychology professors at the University of California, Riverside, have shared 35 how-to tutorials for teaching with Zoom and other online meeting tools faculty members around the country are using amid the move to virtual instruction. Topics the two have covered include lighting subjects, how to show PowerPoint slides while speaking and taking attendance during a lecture.

Online instruction should be served in “bite-size pieces,” according to the two professors.

“It would be easy to go on for 25 or 30 minutes in one lecture, and that’s too much. People will tune out,” said Liz Davis, an associate professor of psychology at the university. “It’s important to emphasize in our tutorial videos how important that is in online instruction.”

The ideal online class converts a lecture into a conversation, breaking it up with interactive prompts, said Annie Ditta, a teaching professor in Riverside’s psychology department. But that can take months of planning, so she advises colleagues to go easy on themselves.

“You have to turn 10-week classes into all-online immediately, so put it online however you can,” Ditta said.

— Paul Fain

New York AG Concerned About Zoom

March 31, 10:30 a.m. New York’s attorney general is questioning the videoconferencing tool Zoom about its privacy and security policies.

Letitia James sent a letter to Zoom asking what security measures it has put in place to deal with the increased traffic, according to The New York Times, which obtained a copy of the letter.

James called Zoom “an essential and valuable communications platform,” according to the Times, but she noted several concerns about security.

Zoom has come under scrutiny because of “Zoombombing.” Professionals, teachers and faculty members have reported people who have accessed their Zoom conferences and yelled profanities, showed pornography or displayed racist or anti-Semitic images.

On Sunday, Zoom posted a blog item saying the company changed its privacy policy to address some of these concerns.

James’s office has requested copies of Zoom’s policies.

— Madeline St. Amour

Stimulus Funding and OPM Payments

Colleges and universities that contract with online program management companies to help them transition to online instruction amid the pandemic may be unable to have their costs reimbursed under the $2.2 trillion federal stimulus, according to a blog post from the education practice of Cooley, a law firm.

“Funding cannot be used for payments to contractors for ‘pre-enrollment recruitment activities,’ which could present a challenge for many OPMs that structure their fees as tuition shares and therefore do not distinguish payments made for recruiting activities from payments for other eligible services under the CARES Act,” the blog post said.

— Paul Fain

Bleak Budget Forecast for Illinois

March 31, 9:40 a.m. Predicting the impact of the coronavirus pandemic and resulting recession on state budgets is “virtually impossible,” given many surrounding uncertainties, according to a three-year budget forecast from the Illinois Commission on Government Forecasting and Accountability. But with this caveat in mind, the forecast compared various previous downturns with current scenarios to get some guidelines of what sort of budget hit the state will take. The forecast found that a substantial share of general fund spending by Illinois could be wiped out over multiple years.

“It seems reasonable to offer a scenario with more devastating impacts on revenues in the near-term than even the ‘Great Recession’. As a result, should revenues experience a peak-trough decline of 20 percent, a revenue reduction of over $8 billion would be experienced, although likely spread over multiple fiscal years,” according to the report.

— Paul Fain

Student Loan Guarantor Stops Garnishing Payments

March 30, 6:06 p.m. Ascendium, the nation’s largest student loan guarantor, announced that last week it stopped garnishing wages, tax refunds or Social Security benefits to collect overdue student loan payments, and will not try to involuntarily collect payments for at least 60 days after March 26. Ascendium also stopped contacting borrowers unless they are trying to resolve their debt.

The company also said it is refunding any money collected through messages it sent since March 13.

The announcement comes after U.S. Education Secretary Betsy DeVos ordered those steps on March 25. The stimulus package passed by Congress also ordered a stop to involuntary collections.

— Kery Murakami

March 30, 5:15 p.m. Temple University has made available its Liacouras Center, as well as other facilities, as overflow hospital space at no cost to the city of Philadelphia. The Philadelphia Inquirer has reported that Federal Emergency Management Agency officials are converting the center to a 250-bed emergency hospital.

— Lilah Burke

VCU Moves Students’ Belongings Without Communication

March 30, 5:10 p.m. Virginia Commonwealth University is turning its Honors College into a site for low-acuity patients in the event of a surge at VCU Medical Center.

Students’ belongings are still in the residence hall. They are being “inventoried, boxed, labeled and relocated to storage” for free by the university, according to a news release.

The decision was made before contacting students.

“We apologize for that. We are operating in a crisis situation with many moving parts,” the release said. “We will do better and ask for your understanding as we work through this crisis together.”

Many students apparently found out about the decision through a video that shows someone walking through the residence halls, narrating for the camera that they’ve been assigned to pack everything up and move the belongings.

One student wrote an op-ed for RVA Magazine criticizing the university for its alleged lack of communication.

— Madeline St. Amour

March 30, 4:05 p.m. The FBI has some recommendations for how to handle “Zoombombing,” the practice of interrupting Zoom meetings with inappropriate content.

Two K-12 schools in Massachusetts reported to the FBI incidents of virtual classes being interrupted by profanity or displays of swastika tattoos, according to a news release.

The federal agency recommends the following for those using Zoom:

- Don’t make meetings public. Zoom lets users make meetings private by requiring a meeting password or using a waiting room feature to control who’s admitted.

- Don’t share a link to the meeting on a public social media post. Send the link to people directly.

- Change the screen-sharing option in Zoom to “host only.”

- Ask people to use the latest updated version of Zoom.

- Ensure your organization’s telework policy addresses requirements for information security.

— Madeline St. Amour

Temporary Tuition Cut From Thomas Edison State

March 30, 2:03 p.m. New Jersey’s Thomas Edison State University announced a temporary tuition rate cut for undergraduates who take summer courses from the adult-focused university.

The reduction applies to “visiting” students, Thomas Edison said, meaning students who are not enrolled in a degree program from the university but are taking its courses. The cut will be $145 per credit for in-state residents and $35 per credit for out-of-state students and will apply to May, June or July terms. Per-course tuition rates at the university range from $399 to $544 per credit, depending on state residency and other factors.

“We don’t want students to lose their higher education momentum during this crisis,” Merodie A. Hancock, the university’s president, said in a statement. “This is not the time to charge our visiting students any more than our degree-seeking, enrolled students pay.”

— Paul Fain

March 30, 12:15 p.m. The American Council on Education has created a simulation of where the emergency funds for higher education included in the $2 trillion coronavirus relief package will be distributed.

The bill gives nearly $14 billion to higher education. The simulation, which uses data from the Integrated Postsecondary Education Data System, provides an estimate of where the money will go for general planning. But the U.S. Department of Education ultimately will determine the final dollar amounts.

About $12.5 billion, or 90 percent, of the funding will be allocated to institutions based on a breakdown of 75 percent going toward the full-time enrollment equivalent of Pell Grant recipients and 25 percent for the full-time equivalent enrollment of students who don’t receive Pell Grants.

An alphabetized list of states and their institutions with the estimated funding amounts can be found here.

— Madeline St. Amour

Medical Schools Graduate Students Early

March 29, 12:20 p.m. Some medical schools are graduating students early so they can get to work sooner combating the COVID-19 pandemic. The Boston Herald reported that Tufts University, the University of Massachusetts and Boston University are all graduating students in their final year of medical school early after Massachusetts pledged to give graduating students automatic 90-day licenses to increase the health-care workforce. Medical students in their final year at Columbia University will graduate a month early and will be offered temporary employment at New York-Presbyterian Hospital. New York University also announced last week that it would allow certain medical students to graduate early, pending approval from its regulator and accreditor. And Rutgers New Jersey Medical School announced its final-year medical students would graduate in April instead of May. Rutgers said hospitals will make their own determinations whether students can get an early start to their residencies, which typically start July 1. Rutgers said 62 of its students matched to hospitals in New Jersey, and 58 matched to hospitals in New York, which has more COVID-19 cases than any other state.

The medical school accreditor has issued guidelines for medical schools interested in helping students graduate early. Alison Whelan, the chief medical education officer for the Association of American Medical Colleges, identified a number of considerations for medical students graduating early during a press conference on Friday. Among them, Whelan emphasized that “the M.D. degree gives them the ability to have supervised practice, not independent practice. So creating the appropriate supervision will be necessary. They will also require a special license because they cannot have an independent license, but with the flexibility that many states and Federation of State Medical Boards have been providing in this crisis, that is an issue that will be easily resolved.”

“It’s important to note that these students recently [went] through the match program so they have a contractual obligation to begin residency by June or July, so thinking about what they need to do to transition at the end of this special time of special employment to be ready to meet their contractual requirement to really begin the next step of critical training will be something that both the individuals, their new employers, and their residency programs, will need to consider together,” Whelan said.

— Elizabeth Redden

Yale to Provide 300 Beds, Testing to First Responders

March 28, 4:45 p.m. The mayor of New Haven, Conn., Justin Elicker, yesterday criticized Yale University for declining to make a residence hall available to city police officers and firefighters who may have been exposed to the coronavirus, either directly or through contact with family members. Yale said its student housing facilities were not ready for new occupants and still contained students’ possessions.

Peter Salovey, Yale’s president, said this afternoon that the university would make 300 beds and expedited testing for COVID-19 available to the city’s first responders. Salovey’s statement follows.

“Yesterday, New Haven Mayor Justin Elicker expressed frustration with Yale University’s lack of a swift positive response to his request for the university to provide housing for first responders to COVID-19.

We are eager to help New Haven with this need. We have been working to make this possible — and we agree that we should move as quickly as we can, in service of people doing extraordinary work on behalf of the New Haven community.

Toward that end, we will make 300 beds available by the end of this coming week to first responders and hospital personnel.

Furthermore, we have been working with first responders to make expedited COVID-19 testing in Yale laboratories available to responders who have been exposed to patients.

Additionally, on Thursday we announced a $5 million Yale Community for New Haven Fund to help address the consequences of the epidemic in New Haven.

Now more than ever, Yale and City Hall need to be on the same page. I know how committed all of us across the city and the university are to implementing an effective response to COVID-19, and I will do all I can to support this shared work.”

— Paul Fain

N.Y. Eases Requirements for Health-Care Workers

March 28, 1:24 p.m. New York State has temporarily suspended a wide range of licensing and other requirements for health-care workers in an attempt to mobilize more help in dealing with the pandemic.

Under the executive order from Andrew Cuomo, the state’s Democratic governor, students in academic programs for health-care fields are now able to volunteer in medical facilities and receive educational credit. The order also drops certain record-keeping requirements for health-care workers.

In addition, New York’s health commissioner for one year can modify examination or recertification requirements for emergency medical services providers.

The state also said a regulation to “allow graduates of foreign medical schools having at least one year of graduate medical education to provide patient care in hospitals” now “is modified so as to allow such graduates without licenses to provide patient care in hospitals if they have completed at least one year of graduate medical education.”

— Paul Fain

New Haven Mayor Says Yale Refused Request for Help

March 28, 11:07 a.m. Justin Elicker, the mayor of New Haven, Conn., said Yale University declined a request from the city for the use of a residence hall by asymptomatic city police officers and firefighters, the New Haven Register reported.

The city wanted the Yale residence hall for police officers and firefighters who had been exposed to the coronavirus or have family members who were exposed. Elicker said Friday in a virtual news conference that Peter Salovey, Yale’s president, said no to the request. Elicker then called Steve Kaplan, president of the University of New Haven, who, he said, granted the request within five minutes.

“UNH has rolled out the red carpet for us. They have worked to quickly get students’ belongings out of the dorms, and they are working with us to address other logistical and liability hurdles,” Elicker said. “We are quite close to finalizing an agreement with them so that our police officers and firefighters can begin moving into the space in the coming days.”

A Yale spokeswoman, Karen Peart, in a lengthy written statement described several ways the university is trying to help its local community, including the distribution of university funds, suspension of rent payments on Yale-owned properties, donated food and continuing to pay salaries of 6,000 New Haven residents who work for the university, among other local efforts.

As for the residence halls, Peart said they are not ready for new occupants:

Our student rooms still contain their belongings, but we have teams planning the feasibility of packing and storing all the student belongings so that the rooms could be utilized. We are pursuing schemes that involve professional movers and packers, and using temporary storage. The process will take weeks, as all of the residence hall rooms on campus are filled with student belongings. As soon as we have been able to clear any space, we have informed the mayor that we will let him know. We all wish the situation on our campus were different, but because our students had already gone home for spring recess when we implemented our social distancing restrictions, the rooms aren’t ready for others to live in them.

— Paul Fain

24-Hour Curfew in Alabama College Town

March 27, 4:15 p.m. Tuscaloosa’s mayor has issued an executive order extending a public safety curfew to 24 hours a day.

The curfew will start on Sunday at 10 p.m. and last through April 11, at which point the city will re-evaluate the curfew. Walt Maddox, the mayor, said briefings with doctors and researchers showed an “imminent threat” to the city’s health-care system, according to AL.com.

The curfew in the college town that’s home to the University of Alabama prohibits residents from leaving their homes except to go to work at essential businesses, buy groceries, visit pharmacies, exercise, pick up food or go to the doctor.

The university already had extended its spring break and asked students not to return to campus as the coronavirus spread.

March 27, 3:00 p.m. The Association of Research Libraries on Friday urged publishers to “maximize access to digital content during the emergency conditions of the COVID-19 pandemic.”

Earlier this week, the association signed a statement by the International Coalition of Library Consortia asking publishers to ease any simultaneous usage and interlibrary loan restrictions on subscription-based content. In a separate statement, the ARL said that opening up academic resources ensures students can continue their studies, and “scholars can continue their research and work to end the pandemic. As research library leaders, our member representatives understand that innovation, particularly in emergencies at a global scale, often happens at disciplinary intersections.”

As to research on COVID-19, the association pushed publishers to adopt an “expansive view” of research materials — think articles, book chapters, multimedia and data — “as they temporarily remove paywalls and create open resource portals related to the virus.” Topic-wise, the ARL advised opening up research on respiration, crisis and disaster management and response, clinical psychology, and other areas. More generally, 50 university presses already opened content on Johns Hopkins University Press’s Project MUSE for the rest of the academic year.

ARL remains concerned about educational equity in terms of access to research tools and broadband, not just content, it also said. Member libraries are partnering within their institutions to lend networked devices and Wi-Fi hotspots to students, “and to ensure that students with disabilities have access to the resources they need in the format they need them.” To those ends, the ARL further called on publishers “to use this crisis to ensure they meet W3C Web Accessibility Initiative standards in digital content and platforms as they expand access to educational materials now, and to work as allies with broadband providers to ensure access for all.”

— Colleen Flaherty

Arizona Universities Face Lawsuit Over Fees

March 27, 2:40 p.m. Students have filed a class-action lawsuit against the Arizona Board of Regents, according to a press release from DiCello Levitt Gutzler, the law office handling the suit.

The lawsuit alleges that the University of Arizona, Arizona State University and Northern Arizona University have refused to refund the cost of room, board and other campus fees for the spring semester after the coronavirus outbreak forced campuses to close.

The Board of Regents recently announced that classes would be moved online due to the global health pandemic and encouraged students to move out of their campus residences.

However, the board hasn’t offered refunds for the unused portion of room and board campus fees, the lawsuit contends. Undergraduate room and board fees for this academic year ranged from $10,780 to $13,510 at the three universities.

Arizona State and Northern Arizona have not offered any fee refunds. The University of Arizona offered a nominal rent credit option, according to the release.

“While the universities were prudent in closing their campuses and encouraging students to vacate their on-campus housing, it is unconscionable for them to attempt to keep the many thousands of dollars in room and board feeds they collected from each student, even though they have terminated the services that these fees covered,” Adam Levitt, a partner at the law firm and co-counsel for the plaintiffs, said in the release. “College is already a monumental expense for students and their families, and to essentially offer them no relief, particularly during a time when millions of Americans are hurting financially, is woefully inadequate, tone-deaf, and needs to be made right.”

— Madeline St. Amour

March 26, 2:15 p.m. The House on Friday approved a massive $2 trillion coronavirus relief package, and President Trump signed it into law a few hours later. The measures will pay as much as $1,200 apiece to adults, increase unemployment benefits and provide loans to businesses.

For higher education, it also offers temporary help for those struggling to make their student loan payments. Most federal loan borrowers are excused from making payments for six months, interest is waived on the loans and loan collectors are prevented from garnishing wages, tax returns and Social Security benefits to collect overdue payments.

The bill, passed by the Senate Wednesday night, also provides $14 billion in funding for higher education institutions, half of which must be used for emergency grants to help students affected by the crisis.

“For institutions of higher learning, it will provide financial relief to colleges and universities and also support grants to displaced students,” Congressman Bobby Scott, the Democratic chairman of the House Education Committee, said this morning before the vote.

“But it is important to recognize that this legislation is only a down payment on the relief that our communities will need in the weeks and months ahead,” he said. “It is critical for us all to understand that the CARES Act is not a stimulus package. It is a disaster relief effort that must continue for as long as it takes to ensure students, workers, and families can survive this crisis.”

In a statement after the vote, Scott added that another stimulus package Congress is expected to consider in a few weeks should “provide relief to cash-strapped student borrowers.”

Advocates for borrowers, though, were disappointed the newly passed measure does not go further. They had supported House and Senate Democratic proposals that called for the government to make borrowers’ payments for them, reducing the balances of those with federal loans by at least $10,000. The House Democratic proposal also would have paid down private student loans by as much as $10,000.

“Congress has taken the first few steps that young people need to maintain stability and security during these unprecedented times,” Jesse Barba, senior director of external affairs for the advocacy group Young Invincibles, said in a statement after the vote.

But, Barba said, “today’s coronavirus bill is a life raft — but not a rescue boat — for the millions of young people who are still grappling with how they will make ends meet as they navigate challenges like unemployment, student loan debt and paying their daily expenses.”

Consumer groups like the National Consumer Law Center also said they will be pushing for Congress in the next package it considers to give relief to borrowers excluded in Friday’s package. Under the legislation passed Friday, those with older Perkins and Federal Family Education Loans will not have their payments or interest deferred and are still subject to garnishments. The National Consumer Law Center said on Thursday that 1.2 million borrowers were excluded, but said on Friday after doing further analysis that the number is about eight million.

However, a spokesman for Republican Senator Lamar Alexander, chairman of the Senate education committee, said in a statement Friday that borrowers with those loans could consolidate them into direct loans and be eligible for relief.

Colleges and universities have also been disappointed that they received far less than the $50 billion they sought to help them pay for the cost of dealing with the crisis.

“Congress must do more in the weeks ahead to bolster the resources and protections provided to students, researchers, universities, laboratories, hospitals, and medical professionals,” Association of American Universities president Mary Sue Coleman said in a statement after the vote.

— Kery Murakami

NCAA’s Division III Faces Debt

March 27, 12:03 p.m. The National Collegiate Athletic Association’s Division III will face a deficit of $7.6 million this fiscal year, as all the NCAA’s divisions expect to lose about 70 percent of their annual revenue due to the cancellation of winter and spring athletics championships.

The NCAA announced yesterday that Division III’s revenue allocation from the association for fiscal year 2019-20 will be $22.3 million less than it was last year, as a result of losses caused by the coronavirus pandemic. A Division III committee on strategic planning and finance decided on Tuesday to cancel several student and staff development programs and conferences to cut down on costs for the remainder of the year, an NCAA press release said.

“The financial loss for Division III will be significant, but money should never take precedence over life. We value people above all else,” Fayneese Miller, chair of the Division III committee and president of Hamline University in St. Paul, said in the release.

— Greta Anderson

NYU Dean Under Fire for Dancing Video

March 27, 11:15 a.m. The dean of New York University’s Tisch School of the Arts is under fire from students.

Tisch students have been advocating for a partial refund of tuition, arguing the forced switch to remote learning due to the coronavirus pandemic won’t provide the same level of education for drama and the arts that in-person instruction would have.

Students have been emailing Allyson Green, dean of the school, to fight for a partial refund. So far, Green has firmly said no.

But a video she attached to her latest email is making the rounds on social media and creating ire among students who see it as tone-deaf, according to an independent blog run by NYU students.

In the video, Green dances to the song “Losing My Religion” by R.E.M. She invited students to dance with her in the body of the email, according to reports.

— Madeline St. Amour

Most Benefiting From Loan Payment Pause Are High-Income

March 26, 6:30 p.m. The 60-day pause on student loan payments for many borrowers in the stimulus package, which is expected to be passed by the U.S. House on Friday, mostly will lead to more money in the pockets of the highest-income households, the Urban Institute said.

Only two-thirds of student loan borrowers in 2016 — according to the most recent available data — were making payments on their loans and would have extra cash during the pause, according to the analysis.

Ninety percent of the highest-income households were paying down their loans, while only 30 percent of the lowest-income households were making payments and would have extra money from being excused from loan payments.

Of the 33 percent not making payments, most cited a loan forbearance, postgraduation grace period or loan forgiveness program. But a substantial fraction of those who were supposed to be making payments said they were not because they could not afford to, said the analysis by Matthew Chingos, the Urban Institute’s vice president for education data and policy.

Chingos said the data have implications for future stimulus packages. “If Congress’s goal is to increase households’ available cash and stimulate the economy, direct payments to families will more effectively accomplish that than loan forgiveness,” he wrote.