Facebook pulls out of San Francisco gaming conference

By Hannah Murphy

Facebook has pulled out of next month’s Game Developers Conference in San Francisco over coronavirus fears.

The world’s largest social media network said on Thursday that “due to the evolving health concerns surrounding Covid-19, Facebook’s [artificial reality and virtual reality] and gaming teams will not be attending GDC this year”.

The company, which makes the Oculus virtual reality headsets, added that it plans to hold meetings with its GDC gaming partners “remotely” and will make any announcements such as product reveals via video or online posts. “We continue to collaborate with UBM, GDC’s parent company, and our partners, and thank them for their efforts,” a Facebook company spokesperson said.

The spokesperson added that Facebook would not attend Boston-based gaming conference PAX East at the end of February. However, it still plans to attend the RSA cyber security conference in San Francisco next week — due to be held at the same conference centre as the GDC — though it said it was “continuing to watch the situation closely”.

“The GDC team is following developments around the Novel Coronavirus closely as we take the health and safety of our game development community very seriously,” the GDC said in a statement.

“Following the strict quarantine laws put in place by the US government and guidance from the Department of Public Health, WHO and CDC, which has seen us put in place enhanced on-site measures, we are confident that the Game Developers Conference will follow in the footsteps of other large and successful international events taking place at the Moscone Center.”

Fisher & Paykel increases sales forecast amid outbreak

New Zealand’s Fisher & Paykel Healthcare raised its forecast for earnings and revenue after seeing a rise in demand tied to coronavirus.

The company manufactures a variety of home health care and hospital products, including oxygen masks.

It now expects full-year operating revenue of NZ$1.2bn ($768m), up from a prior estimate of NZ$1.19bn using a consistent exchange rate, for the fiscal year ending on March 31. Net profit after tax is expected to hit NZ$260m to NZ$270m, compared with a previous range of NZ$255m to NZ$265m.

“We’ve seen better-than-expected sales in our homecare product group combined with continued strong growth in our hospital product group. This includes an increase in demand from China related to the Covid-19 coronavirus outbreak,” said chief executive Lewis Gradon.

While Fisher & Paykel Healthcare doesn’t have a factory in China, some of its suppliers are based there. “At this stage, we do not anticipate any significant impact on supply to our existing customers. We will continue to assess this on an ongoing basis, particularly if the outbreak escalates or continues for a prolonged period,” Mr Gradon said.

China to meet trade commitments to buy American goods, senior US official says

By Brendan Greeley

The US believes that despite the outbreak of the coronavirus, China will buy American goods as outlined in a phase one trade deal signed by Washington and Beijing last month.

“At this stage we’re not expecting changes to implementation of phase one,” a senior administration official said. “Commitments are to make purchases over a period of time. We still expect them to meet their commitments, but it’s over a period of time.”

As part of the deal, China agreed to buy $200bn more in US goods than it did in 2017, the baseline before the start of the trade war, over the course of two years.

Norwegian cancels Asia trips through September, warns of earnings blow from outbreak

Norwegian Cruise Line has cancelled all voyages in Asia through the end of September and warned of a blow to its full-year earnings from the coronavirus outbreak.

“The effects of the coronavirus outbreak in our business has been swift and severe and the continuous global headline news coverage has been substantial and unrelentless,” said Norwegian chief executive Frank Del Rio on the company’s earnings call.

The Miami-based company said prior to the emergence of Covid-19 “2020 was shaping up to be an incredibly good year”, however as a result of cancellations and modifications to its Asia trips and refund to customers, the company now expects a 75-cent hit to its full-year adjusted earnings. The company had forecast 2020 adjusted earnings between $5.40 and $5.60 per share, excluding the impact from the outbreak. Norwegian shares fell 4 per cent on Thursday.

The company did however say that over the last five days it has seen a decrease in cancellations when compared to the prior three weeks.

Cruise companies have come under pressure amid the outbreak. Royal Caribbean said last week it would take a roughly 65-cent hit to its 2020 EPS, while Carnival said it could see a hit of between 55 to 65 cents a share on its full-year earnings if it were to suspend all of its operations in Asia through the end of April.

Mr Del Rio said on the call “unfortunately the cruise industry drew much of the media’s focus primarily due to the quarantine of a competitor’s cruise vessel in Japan”, referring to the Diamond Princess, a cruise ship managed by Carnival Corp’s Princess Cruise Lines.

The World Health Organisation on Thursday noted than more than half of coronavirus cases outside of China were found among passengers on the Diamond Princess.

US stocks sink more than 1 per cent in morning trade

US and European stocks staged a sharp turnround, with Wall Street’s main equities gauges tumbling more than 1 per cent in late morning trade.

The S&P 500 and Dow Jones Industrial Average were each down 0.9 per cent just before midday on Thursday, recovering from drops of as much as 1.3 per cent. The Nasdaq Composite fared worst, down 1.4 per cent, but coming in from a decline of as much as 1.8 per cent.

Investors spent most of the morning processing a stream of cautious outlooks from multinationals, including P&G, Yum Brands and 3M, which have variously warned on the impact the coronavirus might have on their operations during the quarter.

Investors continued to head to haven assets, bidding up government bonds and gold. The yield on the benchmark 10-year US Treasury was down 5.8 basis points at 1.5118 per cent, while that on the two-year Treasury eased 3.9bp to 1.3871 per cent.

The declines punctuated a session that saw the main US stock indices trade around par for the first part of the day, and a sharp rise in China’s stock market after the country’s central bank cut benchmark interest rates in an effort to support the economy.

European stocks sank. The Stoxx 600 and Germany’s Dax both closed 0.9 per cent lower, while London’s FTSE 100 reversed its gains to finish the day with a drop of 0.3 per cent.

The CSI 300 index of Shanghai- and Shenzhen-listed stocks closed 2.3 per cent higher on Thursday, leaving it 1.4 per cent below its peak this year on January 13, after the People’s Bank of China cut the one-year loan prime rate was reduced by 0.1 percentage points to 4.05 per cent.

Albemarle warns of “ripple effect” of coronavirus

Henry Sanderson in Lond

Albemarle, the world’s largest lithium producer, has warned that a slowdown in the Chinese electric car industry due to coronavirus could have “ripple effects” on the business.

Luke Kissam, Albemarle’s chief executive, said lithium supplies could start to build up at battery manufacturers, which could hit the company’s sales later in the year.

“What remains to be seen is for the full year are the OEMs [carmakers] going to run fast enough to soak up the inventory levels of lithium – or will there be a ripple effect later in the year that puts downward pressure [on earnings],” he said.

Mr Kissam said there had been “minimal order reductions” so far from its customers due to the virus but there were “logistics delays” in China. Albemarle’s plants in Xinyu and Chengdu were operating at reduced capacity and the company was working with the local government on resuming normal operations, he said.

“The potential impact on deliveries to our customers and deliveries of raw materials to our facilities remains an area of concern,” he said.

North Carolina-based Albemarle said its adjusted earnings this year could fall by up to 15 per cent due to weak lithium prices and the impact of the virus. It forecast adjusted EBITDA of between $880m to $930m.

Mr Kissam also said the company’s Kemerton lithium hydroxide conversion plant in Australia could be delayed due to the coronavirus and the impact on getting equipment from China. Albemarle started work on the plant in January 2019.

Members of Congress begin lobbying to make sure coronavirus treatments are affordable

By Hannah Kuchler

We may not have a proven coronavirus treatment or even a potential vaccine yet but members of Congress are already lobbying the President to make sure that they will be affordable, as high drug prices worry patients across the United States.

In a letter on Thursday, 46 members of Congress led by Representative Schakowsky, a Democrat from Illinois, have called on President Trump to stop drugmakers putting “profit-making interests ahead of public health priorities”.

The lawmakers want to prevent the US from granting an exclusive license to any private manufacturer for a coronavirus vaccine or treatment in any government grants or contracts.

“Providing exclusive monopoly rights could result in an expensive medicine that is inaccessible, wasting public resources and putting public health at risk in the United States and around the world,” they write.

The letter also quotes a report released on Thursday from Public Citizen, a progressive consumer rights advocacy group, that estimates the US National Institute of Health has spent nearly $700m on research and development related to the category of coronaviruses since the 2002 SARS outbreak, while pharma companies have devoted “startlingly little resources”.

3M boosting production of masks to meet demand

3M, the US group behind Scotch tape and Post-it notes, is boosting production of masks in response to a spike in demand due to coronavirus.

Chief executive Mike Roman said the company is ramping up production to “full capacity” globally, including China, with demand for 3M respiratory protection and some health care products currently outstripping capacity.

“We’re working 24/7 to ramp up and be able to meet as much of that demand as we can,” Mr Roman said during a conference on Thursday.

That demand has offset some of the fallout from companies shutting down operations in China, he added, though it remains too early to determine the outbreak’s overall impact on the first quarter.

3M expects to get a “better view” of the full-year impact in the coming weeks, and the possibility remains that growth in China “could still be kind of in line” with previous expectations, Mr Roman said.

Early results from clinical trials coming soon

By Clive Cookson and Mamta Badkar

Dr Tedros told the WHO daily press conference in Geneva: “We’re looking forward to results from two clinical trials [in China] of therapeutics prioritised by the WHO R&D Blueprint.

“One combines two drugs for HIV, lopinavir and ritonavir, and the other is testing an antiviral called remdisivir. We expect preliminary results in three weeks.”

Remdisivir is an experimental drug developed by Gilead, the US drug company, which is not licensed for clinical use anywhere. The lopinavir/ritonavir combination has been used for 20 years to treat Aids.

Dr Tedros added that the WHO had a call with faith-based organisations on Thursday in an effort to reach communities with messages to prevent the spread of the coronavirus.

He also said that while the data from China showed a decline in new cases, “this is not time for complacency”.

US stocks flat in opening trade

US stocks traded around par in early trading, relatively unmoved following the decision by China’s central bank to cut interest rates in an effort to support the economy there from fallout stemming from the coronavirus.

The S&P 500 was up a fraction of a point within the first half hour of trade on Thursday morning, while the Nasdaq Composite was down 0.1 per cent.

That follows a soft session for European equities, where the Stoxx 600 was down 0.4 per cent, Germany’s Dax was 0.1 per cent lower and London’s FTSE 100 edged 0.1 per cent higher.

The CSI 300 index of Shanghai- and Shenzhen-listed stocks closed 2.3 per cent higher on Thursday, leaving it 1.4 per cent below its peak this year on January 13, after the People’s Bank of China cut the benchmark interest rate.

The one-year loan prime rate was reduced by 0.1 percentage points to 4.05 per cent. Economists expected the cut after the PBoC on Monday reduced its medium-term lending rate, which acts as a low point for the LPR, by the same amount.

P&G says quarterly results to be ‘materially impacted’ by outbreak

Consumer goods company Procter & Gamble said its results for the January to March quarter in China, the company’s second largest market, and overall will be “materially impacted” by the coronavirus outbreak.

Speaking at a conference in Boca Raton, Florida, Jon Moeller, chief operating officer of P&G, said the company is facing “demand and supply challenges” as store traffic has declined and its 387 suppliers are working to resume operations. Here are his remarks in full:

We face the demand and supply challenges associated with the coronavirus outbreak. China is our second largest market—sales and profit. Store traffic is down considerably, with many stores closed or operating with reduced hours. Some of the demand has shifted online but supply of delivery operators and labor is limited.

There are also impacts outside of China: travel retail, a significant reduction in department store traffic in many Asian metro areas, and global supply. We access 387 suppliers in China that ship to us globally more than 9,000 different materials, impacting approximately 17,600 different finished product items. Each of these suppliers faces their own challenges in resuming operations.

The operating challenges change with the hour, and of course the path of the virus is unknown, making it very difficult to provide precise estimates of impact.

Despite that, Mr Moeller re-affirmed the company’s previously announced fiscal year earnings and sales guidance ranges.

KFC owner says virus impact could stretch beyond first quarter

Yum Brands, the owner of KFC, Pizza Hut and Taco Bell fast food restaurants, warned that the operations of its largest master franchisee, Yum China, have been “significantly impacted” by the outbreak of the coronavirus and that the adverse effects of the disease could stretch beyond the end of the first quarter.

The US group has a “significant number” of KFC and Pizza Hut concept restaurants in mainland China, operated by Yum China, and the spread of Covid-19 have resulted in many of these locations being temporarily closed or having their operating hours shortened.

The outbreak has also impinged on the ability of Yum China’s suppliers to provide food and other necessary supplies to those concept stores on the mainland, and have also resulted in sales declines at stores in Hong Kong and Taiwan.

“[W]hile it is premature to accurately predict the ultimate impact of these developments, we expect our results for the quarter ending March 31, 2020 to be significantly impacted with potential continuing, adverse impacts beyond March 31, 2020,” the company said in its annual 10-K filing, released on Thursday morning.

Yum operates its fast food chains worldwide, except in China. There, the various brands are operated by a separate company, Yum China, which pays Yum a “continuing fee” of 3 per cent on system sales of its concept restaurants on the mainland.

Those fees “represented approximately 20 per cent of the KFC Division and 16 per cent of the PH Division operating profits in the year ended December 31, 2019”, Yum said in its 10-K. The KFC division reported operating profits of $1.05bn in 2019, while Pizza Hut reported an operating profit of $369m.

Schneider Electric warns of €300m hit from coronavirus

David Keohane reports from Paris:

Schneider Electric, the French electrical equipment group, has warned that coronavirus has already inflicted a €300m hit to its revenues this quarter.

Chief executive Jean-Pascal Tricoire told the Financial Times:

It seems to me that the figures we get [coming out of China] are more encouraging. So it’s too early to say, but it will impact the first quarter and it will impact the second quarter but we think we’re going to repair or catch up on the impact within the year.

Schneider, which generated 15 per cent of its revenues in China in 2019, has now reopened 80 per cent of the factories that were forced to shut this year due to the coronavirus outbreak. However, the closures have cost the company $300m.

HSBC cancels London event

HSBC has cancelled an event in London to celebrate Chinese New Year.

The bank was planning to hold a media party at the upmarket Shangri-La hotel in the Shard skyscraper on February 26. But on Thursday it emailed guests saying that, “given the Covid-19 outbreak in China, we feel the timing is inappropriate to host a celebration”.

Police spread awareness in one of China’s most remote regions

Police officers have mounted horseback patrols in China’s north-west Xinjiang region, as they promote awareness of the virus in some of the country’s most remote locations.

Photo: AFP via Getty Images

Iran reports new cases, following first deaths

Mehrnoush Khalaj in Tehran writes:

Iran’s health ministry has confirmed three more cases, a day after local authorities reported the country’s first deaths from the virus.

Mohammad Mehdi Gouya, director general of communicable diseases at the centre for disease control and prevention in Iran’s health ministry, told the official IRNA news agency that all of those infected were residents of the holy city of Qom. He added that they had had no contact with any foreigners, including Chinese.

Families and relatives of the patients and the deceased individuals were not isolated but had been educated on personal hygiene and care, Dr Gouya said. He added that that five other people who were suspected of having the virus had been transferred to Tehran and hospitalised.

All schools and universities were closed in Qom province, according to semi-official Fars news agency.

Kianoush Jahanpour, a spokesman for the health ministry, suggested that pilgrimage visits to religious sites in the holy city of Qom would be restricted due to coronavirus.

Singapore records another person infected, bringing total to 85

Stefania Palma in Singapore writes:

Singapore has reported another coronavirus case – a 36-year-old Chinese man on a Singapore work pass with no recent travel history to China nor links to previous cases – which takes to 85 the number infected.

Three more people have recovered and have been discharged from hospital, taking the total to 37. Four patients are in critical condition while the remaining 48 in hospital are mostly stable or improving.

A daily round-up

Good morning Americas. As you reach for your smartphone here’s a bite-sized version of the events overnight:

Companies: Multinational after multinational has come out to tell of future travails. Those concerned of a hit to their earnings include Apple supplier Foxconn, Maersk, Accor, Smith & Nephew plus airlines Qantas and Air France-KLM.

But gaming is on the rise. All those hours in lockdown.

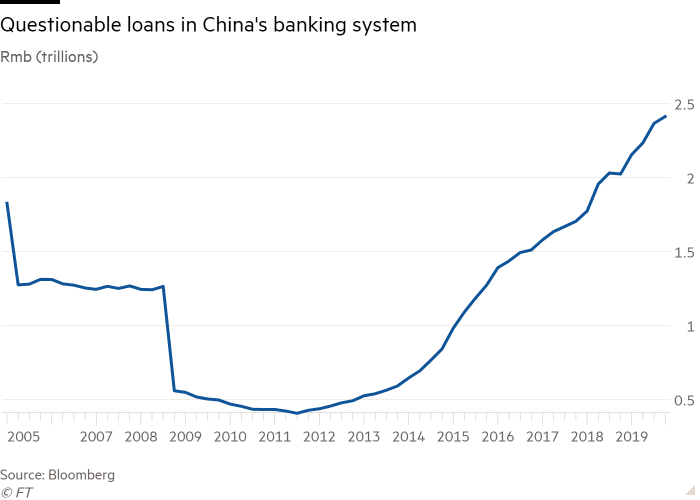

Questionable loans: China’s lenders face an increase of as much as $1tn in questionable loans as some may have difficulty in repaying debt, S&P global ratings warns.

Markets: Yen hits 10-month low as the 2 per cent dive against the dollar unsettles its traditional safety net status. European stocks falter with the Stoxx 600 down 0.4 per cent. China’s stock market meanwhile comes within sight of a full recovery from its coronavirus-driven selloff, propped up by the promise of central bank support. US futures point to a 0.2 per cent slide on the S&P 500 when it opens.

Correction caution: Goldman Sachs analysts say the risk of a correction in equity markets is “high” as investors are underestimating the coronavirus impact.

Rate cut: Chinese lenders lower their benchmark rate.

Tally: Deaths: 2,130, with two being among the ill on the Diamond Princess cruise ship; 75,751 confirmed ill, with South Korea surpassing the 100 mark to leapfrog Singapore’s tally. More than 16,000 have recovered. Figures pulled off the Johns Hopkins CSSE dashboard.

Coronavirus cases onboard Diamond Princess rise to 634

Robin Harding reports from Tokyo:

Japan has reported 13 more cases of coronavirus aboard the stricken Diamond Princess cruise ship, taking the total to 634 out of the 3,063 passengers and crew tested to date. The vessel, quarantined in Yokohama, has suffered the worst outbreak of the virus outside China.

The Japanese government also confirmed that two more quarantine officials have acquired Covid-19, taking the total infected to four. One of the new cases worked for the health ministry and another for the Cabinet Secretariat, which is involved in disaster response.

Earlier on Thursday, the health ministry said that two passengers on the Diamond Princess had died from the virus. One was a man and the other a woman; both were Japanese and in their eighties. They were the first fatalities on the cruise ship.

The confirmation of fresh cases came as Japan continued to release hundreds of passengers who have completed two weeks of quarantine and tested negative for the virus. Foreign authorities, including the US Centres for Disease Control, have said the quarantine was ineffective and the passengers pose an ongoing risk of spreading the disease.

However, a report published on Wednesday by Japan’s National Institute of Infectious Diseases found the quarantine strategy had been successful in stemming contagion on board. “The decline in the number of confirmed cases … implies that the quarantine intervention was effective in reducing transmission among passengers,” the report said.

Yen’s sharp sell-off hits currency’s haven status

Leo Lewis and Robin Harding report:

The yen’s reputation as a haven has taken a heavy blow as the currency sold off sharply against a backdrop of a weakening economy and the deadly coronavirus epidemic.

The yen dropped as low as ¥112 by the morning in Europe, a 10-month low, and has now fallen more than 2 per cent this week against the US dollar.

The fall represents a departure from a pattern in recent years whereby the yen strengthens whenever unsettling news prompts investors to sell riskier assets. That change could reflect pessimism about the outlook for Japan, with dismal economic data and the spread of coronavirus leading to strong investment outflows from domestic institutions.

Mansoor Mohi-Uddin, a foreign exchange strategist at NatWest Markets, said that markets were likely worried about Japan’s economy, particularly given the spread of the coronavirus.

European stocks edge lower despite Chinese rally

It has been a muted morning for European stocks, with few sharp moves despite an overnight rally in mainland Chinese shares.

China’s stock market is within sight of a full recovery from its earlier coronavirus-driven selloff. The sharp turnround has been driven by the promise of central bank support to help ride out any economic damage this year.

The CSI 300 index of Shanghai- and Shenzhen-listed stocks closed 2.3 per cent higher, 1.4 per cent below its peak this year on January 13.

The gains followed Chinese banks cutting their benchmark interest rate with a drop in the one-year loan prime rate by 0.1 percentage point to 4.05 per cent. Economists had expected the cut after the People’s Bank of China on Monday reduced its medium-term lending rate, which acts as a low point for the LPR, by the same amount.

Hotel chain Accor says outbreak will dent revenues by at least €5m

Alice Hancock writes:

Hotel chain Accor, owner of the Sofitel and Ibis brands, has warned that it will take a hit to revenues in China of at least €5m from the outbreak of coronavirus.

Sebastien Bazin, the group’s chief executive, said in a presentation to investors on Thursday that the full impact could be more but that it would depend on how long the virus lasted.

Of Accor’s 370 hotels in Greater China, 200 are closed. The Chinese market accounts for 10 per cent of the group’s rooms and 3 per cent of revenues.

Mr Bazin also noted that there had been a knock on effect on bookings across Asia but that he could not provide specific figures on the impact there as it was varied in different countries.

“There has been a lot of cancellation, a lot of rebooking,” he said, adding that he would have a better idea of overall fallout in 20 to 30 days.

Accor said that its revenue per available room in the Asia-Pacific region, which accounts for around a third of the group’s revenues, had already been heavily affected by the US-China trade war, the Hong Kong protests and the bushfires in Australia. Overall revpar was down 6.1 per cent in 2019.

Revpar in Hong Kong in the final quarter of the year was down 50 per cent.

Accor’s total revenues for the year were up 3.8 per cent on a like-for-like basis to €4bn. It also announced two share buyback programmes of €600m in 2020 and €400m in 2021.

Most companies in southern China stick to investment plans

Sue-Lin Wong writes:

Three-quarters of companies in southern China will not change their investment plans due to the coronavirus outbreak, a survey of 399 groups from the American Chamber of Commerce in South China shows.

Less than 2 per cent of the companies – mostly headquartered in the US, China and other parts of the Asia Pacific – indicated they plan to change their investment strategy while 23 per cent said they were undecided. The majority of those surveyed are in manufacturing, retail, logistics and transportation.

“The primary difficulties reported by the companies were lack of availability of protective masks, sanitisers and other sanitary products, as well as difficulties faced in restarting operations created by various regulating authorities,” Harley Seyedin, president of the chamber of commerce, wrote in a report released on Thursday.

More than 76 per cent of the companies surveyed said their 2020 revenues would be hit because of effects from the coronavirus outbreak. Those polled said the most helpful policies from the Chinese government would be tax cuts and rent reductions.

No company reported that their suppliers or customers had invoked force majeure, a clause that allows unavoidable catastrophes as a reason for not fulfilling a contract, but some companies predicted they would need to use it or it would be used on them, depending on how long the outbreak lasts.

Shipping group Maersk warns Covid-19 will hit earnings

Richard Milne reports:

AP Moller-Maersk warned that the coronavirus outbreak would hit its earnings this year as the world’s largest container shipping company warned of a “very, very weak February and weak March” due to the deadly epidemic.

Soren Skou, Maersk’s chief executive, told the Financial Times that “visibility is low and a lot lower than we would like due to coronavirus” as the Danish group said its earnings before interest, tax, depreciation, and amortisation this year would be well below analyst expectations at $5.5bn.

But Mr Skou added that on current trends the coronavirus “will not have been a huge event for us” as he expected a sharp rebound in global trade in April, May and June as Chinese factories started running again.

Maersk is a bellwether for global trade, transporting more than one in six containers by sea, and is forecasting another weak year for demand after a turbulent 2019 hit by trade tensions between the US and China as well as overcapacity in the shipping industry.

Mr Skou trumpeted the fact that despite the trade tensions, Maersk’s ebitda last year increased by 14 per cent to $5.71bn, just below analysts’ forecasts. Analysts had expected ebitda this year to rise to $5.94bn, but Maersk warned its own outlook of $5.5bn was subject to considerable uncertainty.

Stocks in China rally after rate cut

Hudson Lockett reports:

Chinese equities rallied on Thursday after the country’s banks cut their benchmark lending rate, putting China’s stock market within sight of a full recovery from the coronavirus-driven sell-off.

The CSI 300 index of Shanghai- and Shenzhen-listed stocks closed 2.3 per cent higher, leaving the benchmark just 1.4 per cent below its peak this year on January 13.

The gains followed a drop in the one-year loan prime rate by 0.1 percentage point to 4.05 per cent at the start of trading. Economists had broadly expected the cut after the People’s Bank of China on Monday reduced its medium-term lending rate, which acts as a low point for the LPR, by the same amount.

But gains did not extend to China’s renminbi, which fell 0.2 per cent to Rmb7.0137 per dollar. The currency is on track for its worst month since August, when trade tensions with the US were at a fever pitch.

Stocks elsewhere in the Asia-Pacific region made only limited gains, with Tokyo’s Topix index rising 0.2 per cent. Futures tipped Europe’s Stoxx 50 index to drop 0.1 per cent at the open while the FTSE 100 was expected to rise by as much at the start of trading in London.

*This post has been amended to correct the loan prime rate

Apple supplier Foxconn predicts disruption to sales

Kathrin Hille reports from Taipei:

Apple supplier Foxconn Technology Group expects its full-year revenue to suffer from the disruption of China-based manufacturing by the coronavirus epidemic.

The warning from the world’s largest electronics contract manufacturer is the clearest indication yet of the scale of the outbreak’s impact on the global tech supply chain.

“As we are moving ahead with the reopening of mainland China manufacturing complexes in a relatively cautious manner, this will indeed have a negative impact on full-year revenues,” Hon Hai, the group’s Taipei-listed flagship company, said in a statement to the Taiwan Stock Exchange.

The company said its “cautious” resumption of work was due to the need to put the safety of its employees first and follow local regulations on the return to work.

In its factory compound in the central Chinese city of Zhengzhou, one of the largest iPhone manufacturing bases, the company this week delayed the return of workers because the requirement to spread them one person to a room as opposed to the usual eight per room means it has no longer enough dorm capacity to accommodate all staff.

Last week, a person familiar with the situation, told the Financial Times it would take the company “weeks” to ramp production up back to normal levels.

Foxconn’s revenue warning on Thursday came in response to a report by Taiwan’s China Times which, referring to unnamed investor sources, said the group’s revenue could plummet by as much as 45 per cent in the first quarter.

It follows a profit warning this week by its largest customer Apple.

Hon Hai said its manufacturing plants outside China including in Vietnam, Indonesia and Mexico are running at full capacity, and will keep to its plans to expand capacity.

Two cruise ship passengers die from coronavirus in Japan

Two passengers, a man and woman in their 80s, from the Diamond Princess cruise ship have died from the coronavirus Covid-19, Robin Harding reports from Tokyo.

The deaths, the first from a cruise ship that has suffered the worst outbreak of the virus outside China, will be announced once the ministry has permission from their families, Japan’s health minister Katsunobu Kato told the Diet on Thursday.

News of the deaths came as passengers tested free of the virus disembarked from the vessel in Yokohama. As many as 621 on board the liner are infected.

“The two patients were transferred to hospital when they showed symptoms and I believe they have received the best possible medical care,” said Mr Kato. They are 87 and 84 years old, Japanese media said.

Kentaro Iwata, the doctor who caused global concern after posting a video about inadequate infection control on the Diamond Princess, said that news of the deaths was not a surprise given that elderly passengers are at high risk after contracting the virus.

Air France-KLM expects €150m to €200m hit from coronavirus

Air France-KLM said it expects flight cancellations and low demand linked to coronavirus will result in a €150m to €200m hit to earnings.

The airline group based its estimate on the suspension of China flights for February to March on the assumption that flights would resume in April.

“Recent developments with regards to the Covid-19 have impacted the demand outlook, especially in the Asian network,” Air France-KLM said. “As a consequence the Group anticipates unit revenues at constant currency to be down for the first quarter of 2020.”

Air France and KLM have suspended flights to Beijing and Shanghai until March 15. Each airline will run flights every other day from March 16, according to announcements made two weeks ago. Air France flights to Wuhan, the centre of the outbreak, are suspended until March 28.

The airline group said its cargo business was hit by the effects of the virus. China cargo flights have also been suspended.

Tool usage offers clues for state of Chinese economy: Nomura

Nomura is monitoring how much excavators are being used in China in an attempt to assess how the country’s economy is affected by the coronavirus outbreak.

Usage data from Komatsu, a manufacturer of construction machinery, showed monthly operating hours per machine in China dropped to 59.3 in January from 124.7 in December. While the research cautions that the fall could be from distortions from the lunar new year holiday, the Japanese bank will be watching these figures closely.

“We believe the print for January-February combined to be much lower than previous years given the slow resumption of business activities driven by the Covid-19 outbreak, the extended lunar new year holiday and various lockdown measures in many cities, towns and villages,” Nomura said.

Nomura is monitoring the Baidu Migration Index to estimate the proportion of people who have returned to work after the break following government-imposed travel curbs. It estimates the cumulative return rate in first-tier cities rose to 27.4 per cent on February 19, the 26th day of the lunar new year, from 26.6 per cent a day earlier. The rate was lower in second- and third-tier cities at 24.4 per cent.

Daily coal consumption at six major power plants is 42.5 per cent below the same period last year, Nomura said. It added that when adjustments are made for household consumption considering people are spending more time at home, the drop in coal consumption for production sectors could be 50.2 per cent year on year.

We reveal the data points that investors are using to assess the state of the Chinese economy here.

![]()

China’s banks face up to $1.1tn surge in questionable loans, S&P warns

China’s lenders may be hit with an increase of as much as Rmb7.7tn ($1.1tn) in questionable loans as the coronavirus outbreak deals a heavy blow to China’s economy, S&P Global Ratings has warned.

The Covid-19 outbreak, which has prompted China to lock down large swaths of its sprawling economy, will cause some individuals and companies to “have difficulty with debt repayment,” S&P said in a report issued on Thursday in Hong Kong.

In a worst-case scenario in which the outbreak does not peak until April, S&P forecasts China’s economy, the second biggest in the world, will expand 4.4 per cent in 2020. That would mark a dramatic slowdown from the 6.1 per cent growth in 2019 and be the weakest pace since 1990, according to World Bank data.

S&P’s base scenario, in which the virus peaks next month, points to 2020 growth of 5 per cent, which would also be the lowest in three decades. Even in the best case in which the virus peaks in February, GDP growth is forecast at 5.5 per cent.

The “growth shock” would cause the value of non-performing loans in China’s banking sector to surge by Rmb7.7tn to Rmb10.1tn in S&P’s worst-case scenario. In the base case, the figure would jump Rmb5.4tn to Rmb7.8tn. In the best case, the NPLs would rise Rmb3.4tn to Rmb5.8tn. The ratio of NPLs to total loans would be 7.8 per cent, 6 per cent and 4.5 per cent in the worst, base and best case scenarios, respectively.

S&P said it also expects Chinese regulators to relax rules for what counts as a bad loan and potentially give certain loans to affected communities and business “special consideration” in how they are accounted for on bank balance sheets.

The ratings firm said it “may take years for domestic banks to revert to normal standards, with long-term repercussions for the creditworthiness of some institutions.”

China has already begun to take action aimed at stimulating its economy and easing conditions in its financial system. The loan prime rate, a key lending rate, was reduced on Thursday after the People’s Bank of China earlier this week reduced another important medium-term lending rate.

Exclusive: Smartphone users in China download record number of games

Leo Lewis and Hudson Lockett write:

Smartphone users in China downloaded a record number of games and other apps as the deadly coronavirus confined tens of millions of people to their homes, in a boost to the $150bn global games industry.

More than 222m downloads were made in China through Apple’s online store in the week starting February 2, according to data provided to the Financial Times by analytics provider AppAnnie.

Average weekly downloads of apps during the first two weeks of February jumped 40 per cent compared with the average for the whole of 2019, the statistics showed. Both timeframes coincided with an acceleration in the viral outbreak, which has killed more than 2,000 people.

“This year downloads continued to grow well into the weeks following the lunar new year holidays as millions of workers and students leveraged mobile apps to seek alternative methods to resume daily activities remotely,” AppAnnie analysts said in their report. Normally, a jump in game downloads over lunar new year falls off sharply in the following weeks.

First Hong Kong residents from Diamond Princess arrive back in city

George Hammond reports:

The first Hong Kong residents to be released from the Diamond Princess cruise ship have arrived back in their home city. 106 of the 364 Hongkongers aboard the quarantined vessel were allowed to disembark and return home, arriving on Thursday morning.

The remaining passengers from Hong Kong are still on the Diamond Princess, which is docked just south of Tokyo, or receiving treatment in hospitals in Japan.

There are 542 confirmed coronavirus cases on the ship, meaning the number of cases on the ship outstrips those in any country outside of China, according to data compiled by Johns Hopkins University. There were 3,700 or so passengers originally aboard.

The returnees to Hong Kong will be quarantined in a government facility for 14 days.

China reports 114 new coronavirus deaths

Health authorities in China reported 114 new deaths from coronavirus to the end of Wednesday, taking the total to 2,118 in the mainland.

There were 394 new cases of the virus following the removal of 279 cases originally given a clinical diagnosis of coronavirus after laboratory tests came back negative. Wednesday’s figures represented a sharp drop from the previous day’s tally of 1,749 new cases.

The national health commission gave the total number of coronavirus cases in mainland China as 74,576.

South Korea traces 23 new coronavirus cases to a church

Song Jung-a reports from Seoul

Confirmed cases of coronavirus in South Korea have more than doubled within a day with the jump in new cases tied to church services in a provincial city.

The country reported 31 new cases of the deadly virus, including 23 cases traced to church services in Daegu, bringing the total number of people infected in South Korea to 82, according to Korea’s Centers for Disease Control and Prevention.

The state-run agency said the outbreak in Daegu, a city about 235km south of Seoul, was traced to a 61-year-old patient and a member of the Shincheonji Church, who has tested positive. The pastor of the church told local media that about 1,000 people attended the same service.

The church in Daegu was closed on Tuesday. The Shincheonji Church said it was investigating the cases and taking preventive measures including replacing church services and meetings with online and family services.

The sharp increase in new confirmed cases has renewed concerns over the spread of the virus, after a lull in reported cases last week. President Moon Jae-in said earlier this week that the economic impact of the novel coronavirus could be bigger and longer-lasting than the 2015 MERS epidemic that killed 38 people in South Korea.

He stressed that the economy needs more stimulus measures to spur faltering corporate investment and domestic consumption. South Korea has announced a Won420bn ($351m) emergency loan plan to support struggling airlines, shipping companies, travel agencies and retailers facing a liquidity crunch.

![]()

China’s benchmark lending rate cut in stimulus effort

Hudson Lockett reports from Hong Kong:

Chinese lenders have cut their benchmark lending rate as Beijing grapples with the fallout of a deadly coronavirus epidemic that has battered the country’s economy.

The one-year loan prime rate was reduced on Thursday by 0.1 percentage point to 4.05 per cent*. Economists broadly expected the cut after the People’s Bank of China on Monday reduced a medium-term lending rate that acts as a low point for the LPR.

The drop in the LPR – which is based on the average lending rate commercial banks extend to their best customers – will lower funding costs for Chinese companies as they deal with intense disruption from measures to contain the Covid-19 outbreak.

Beijing has rolled out dozens of measures to support businesses severely affected by the epidemic, including central bank lending of Rmb300bn to large lenders as well as certain local banks in hard-hit provinces including Hubei, where the outbreak began.

But analysts are still penciling in a sharp drop in economic activity, with Standard Chartered forecasting China’s economy will grow just 2.9 per cent in the first quarter— roughly half the pace seen at the end of 2019.

“The major focus now is to help smaller companies survive,” said Michelle Lam, Greater China economist at Société Générale. Ms Lam said major stimulus from the PBoC was unlikely in the short-term, since many businesses remain closed or are otherwise unable to actually borrow and invest.

“Fiscal policy will be more important — after all, the concern is about maintaining employment stability,” she said, adding that more cuts to the central bank’s medium and short-term lending rates could be expected in the second quarter after the epidemic is contained.

Equities in China opened higher alongside the LPR announcement, with the benchmark CSI 300 index of Shanghai- and Shenzhen-listed stocks climbing 0.7 per cent in morning trading.

*This post has been amended to correct the loan prime rate.

Map: tracking the coronavirus outbreak

Steve Bernard on the FT’s data visualisation team has crunched the latest numbers on the coronavirus outbreak. More than 75,000 people globally have been infected with Covid-19, while the death toll has risen above 2,100.

Coronavirus puts stocks at ‘high’ risk of correction, Goldman warns

Mamta Badkar writes:

US and European stocks are at record levels, but analysts at Goldman Sachs have cautioned the risk of a correction in equity markets is “high” as the impact of the coronavirus on earnings is being underestimated by investors.

“We believe the greater risk is that the impact of the coronavirus on earnings may well be underestimated in current stock prices, suggesting that the risks of a correction are high,” said Peter Oppenheimer, analyst at Goldman Sachs, in a note.

A correction is defined as a drop of 10 per cent or more from a recent peak.

He added: “Equity markets are looking increasingly exposed to near-term downward surprises to earnings growth and while a sustained bear market does not look likely, a near-term correction is looking much more probable,” he said.

Qantas cuts flights to Asia on weak demand

Jamie Smyth reports from Sydney:

Qantas Airways said on Thursday it would implement 15 per cent capacity cuts in flights to Asia until at least May to mitigate the impact of the coronavirus on its business.

The airline said it expects weaker demand as a result of the virus and travel bans, which would result in a A$100-150m ($67m-100m) hit to earnings before interest and tax in the second half of its 2020 financial year. Customer demand for Australian flights has also begun to weaken prompting Qantas to reduce domestic capacity by about 2 per cent, said Alan Joyce, Qantas chief executive.

“Coronavirus resulted in the suspension of our flights to mainland China and we’re now seeing some secondary impacts with weaker demand on Hong Kong, Singapore and to a lesser extent Japan,” he said.

Other key routes, like the US and UK, haven’t been impacted.

Qantas has accelerated its decision to exit its Beijing route and suspended services to Shanghai until at least May due to the spread of the coronavirus, which has killed more than 2,000 people.

Mr Joyce said Qantas, which reported a 0.5 per cent fall in underlying net profit to A$771m for the six months ended December 31, was in a much stronger position than other carriers to manage the impact of the coronavirus.

“I think what we’re going to see out of this is probably a lot of the weaker airlines either being consolidated or going out of business. I think that’s what usually happens in these situations,” he said.

The capacity cuts within Qantas’ network are the equivalent of grounding 18 aircraft, which affects about 700 roles across the group’s 30,000 workforce. The airline will ask some staff to take paid leave and freeze recruitment to protect jobs.

Hubei reports 108 new deaths

The Chinese province at the centre of the coronavirus outbreak reported 108 new deaths to the end of Wednesday, down from the previous day’s tally of 132, which took the total deaths for the region to 2,029.

Hubei health authorities recorded 615 new cases of the virus in Wuhan, but the overall figure for “new cases” for the province was 349 following revisions to counts from other cities. Ten out of 15 cities gave negative counts with Jingmen recording negative 107 cases. There was no explanation given for these revisions.