Ireland has no plans to increase its corporate tax rate – one of the lowest in the developed world – the country’s finance minister has told Sky News, which could scupper Joe Biden’s radical scheme for a global minimum rate.

Paschal Donohoe said that he had “significant reservations” over plans floated by the US president to encourage countries around the world to adopt minimum rates of corporate tax in order to prevent companies from shifting their profits and avoiding payments in future.

He predicted that Ireland will maintain its 12.5% corporate tax rate for many years to come.

In an exclusive interview with Sky News, Mr Donohoe said: “We do have really significant reservations regarding a global minimum effective tax rate status at such a level that it means only certain countries, and certain size economies can benefit from that base – we have a really significant concern about that.”

The comments are important, since Ireland is one of the countries whose agreement would be needed if the US is to succeed with its plans to overhaul global business taxation.

International rules on corporate tax ultimately date back a century, to an era when it was far trickier for businesses to use accounting and legal loopholes to reduce their tax bills.

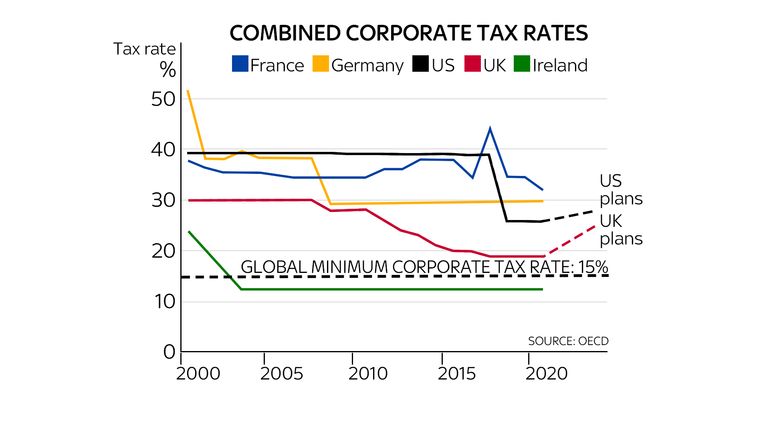

These days billions of dollars of profits are shifted around to countries with lower tax rates, something the Biden administration has vowed to address. The US is planning to raise its own corporate tax rate from 21% to 28% and is increasing the rates for American companies working overseas.

However, it has also proposed that other countries also increase the floor below which business tax rates could not fall, in an effort to prevent American companies from moving their headquarters overseas.

The initial American proposal was for a global minimum rate of 21%, though it has now cut that to a minimum of 15%. This would nonetheless imply Ireland having to raise its tax rate from its current level.

Mr Donohoe said there were no plans to do so.

“I absolutely support and will be making the case for our 12.5% tax rate,” he said. “I believe a rate like that – a low rate – should be a feature of an agreement in the future.

“Our friends and partners in the United States understand our concerns in these matters, but the best kinds of partnerships – the best kinds of friendships – are ones in which you can talk about these matters openly and engage with each other, professionally, and that’s what we’re going to be doing.”

Asked whether he envisaged the Irish 12.5% rate still being in place in five or 10 years’ time, he said: “Yes I do, I do anticipate that there will continue to be a place for a rate such as this and for low rates.”

He added: “I’m proud of the part that it has played in our economic development. That for a country of our scale and size, that we were able to grow our economy, that we were able to grow for many decades, but I always make the case when debating our 12.5% rate, that it is now only part of the competitive offering for an economy like Ireland’s.

“The Irish economic model has many many many foundations now, it has many different pillars of strength, and I’m proud of all of them.”

Mr Donohoe’s comments raise the stakes for the coming negotiations on tax, which will form a part of the G7 meeting of finance ministers taking place in London late next week and are likely to be debated in detail by the Organisation for Economic Co-operation and Development (OECD) later this year.

The OECD has been pushing for reform on corporate taxation for many years. While it is supportive of proposals for a global minimum corporate tax, it has also pointed out that such reforms should be coupled with others which would make it clearer how to assign taxes to given countries.

Michael Devereux, a professor of tax at Oxford University’s Said Business School, said that the reforms were a long time coming.

He said: “I think the tax system as it is, is completely broken. It was set up in the 1920s for a completely different world. And the world of the global economy that we have now is really just too global for the international tax system as it stands.

“We make all kinds of very complicated and arcane decisions about how to allocate taxing rights for profit from one country to another in ways which really have no economic meaning. So I think there is a real case of fundamental reform.

“A minimum tax rate would solve some of those problems but it wouldn’t really get to the real problems of the international tax system, which are complexity: nobody really knows exactly why we have the system that we do. It’s just that we’ve always had it, and it creates a lot of problems, including economic efficiencies, but also profit shifting.”

While some reports have suggested that UK Chancellor Rishi Sunak is against a global minimum tax, Sky News has learned that the Treasury backs Mr Biden’s minimum tax rate, but wants it to be introduced alongside other reforms to the way companies calculate their taxes and apportion them between countries.

A Treasury source said: “We support the global minimum tax rate. But it’s all about getting the full OECD reforms, not just half of it, which is what the global minimum tax rate represents.”

The UK currently levies a digital services tax on the tech giants but Whitehall insiders say if the OECD reforms are implemented in full then that tax would be repealed.

Amid repeated criticism from the UK government, including former Brexit negotiator Lord Frost, about the way the Northern Ireland protocol is being implemented by the EU, Mr Donohoe said: “Minister Frost and his team negotiated this protocol. The protocol and the treaty was passed by the House of Commons.

“The protocol was needed because of the form of Brexit that the British government wanted to implement, which we respect. That’s their sovereign mandate, but it’s equally important that our membership of the European single market, which is also an exercise of sovereignty on behalf of the Irish people, is also recognised in this debate.”

Asked whether he felt the implementation was going well – something Lord Frost has complained about – Mr Donohoe said: “There are many different tests, regarding the protocol. One of my tests, as a member of the Irish government, is: do we have a border between Northern Ireland and Ireland that is hard in nature?

“And secondly, has the implementation and execution of Brexit in any way materially affected Ireland’s membership of the single market?

“Neither of those two things have happened, and from my point of view that is critical to the prospects of our own country and I believe the long term interests of the island.

“So I make the case, for those tests and how the protocol passes them, but I’ve equally acknowledged that there are issues associated with the protocol, and that is why the commission is engaging with the British government.”